James Hardie Industries PLC ADR (JHX): Price and Financial Metrics

JHX Price/Volume Stats

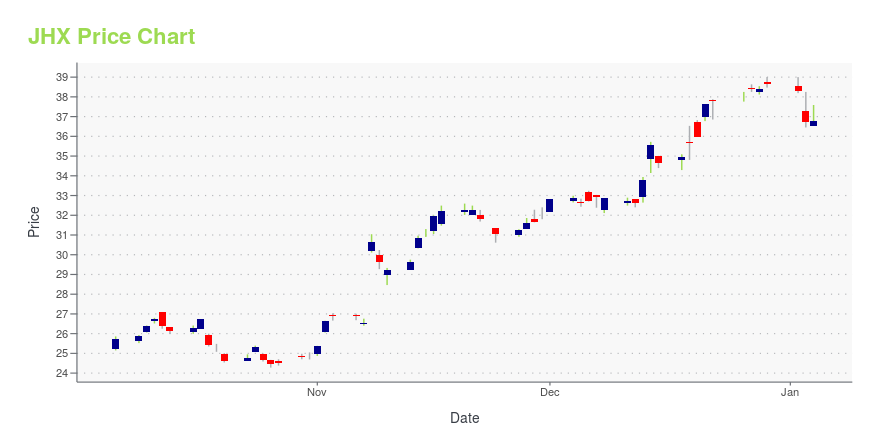

| Current price | $35.08 | 52-week high | $41.98 |

| Prev. close | $34.34 | 52-week low | $24.28 |

| Day low | $34.57 | Volume | 44,600 |

| Day high | $35.20 | Avg. volume | 60,662 |

| 50-day MA | $32.67 | Dividend yield | N/A |

| 200-day MA | $34.47 | Market Cap | 15.22B |

JHX Stock Price Chart Interactive Chart >

James Hardie Industries PLC ADR (JHX) Company Bio

James Hardie Industries plc is a global building materials company and the largest global manufacturer of fibre cement products. Headquartered in Ireland, it is a dual-listed company, being listed on the Australian and New York Stock Exchanges. Its management team currently sits in Chicago, Illinois, United States. James Hardie was plagued by several asbestos-related scandals in the 20th century. (Source:Wikipedia)

Latest JHX News From Around the Web

Below are the latest news stories about JAMES HARDIE INDUSTRIES PLC that investors may wish to consider to help them evaluate JHX as an investment opportunity.

PGT Innovations (PGTI) Gains as It Sells Stake to MasonitePGT Innovations' (PGTI) combination with Masonite is set to provide significant near-term value to its shareholders while enabling them to participate in the long-term upside opportunity of the combined company. |

Are Construction Stocks Lagging James Hardie Industries (JHX) This Year?Here is how James Hardie (JHX) and Lennar (LEN) have performed compared to their sector so far this year. |

Caesarstone (CSTE) to Close Richmond Hill Manufacturing FacilityCaesarstone (CSTE) plans to shut down its Richmond Hill manufacturing facility for $20 million in annual savings. |

Is Now An Opportune Moment To Examine James Hardie Industries plc (ASX:JHX)?Today we're going to take a look at the well-established James Hardie Industries plc ( ASX:JHX ). The company's stock... |

Is James Hardie Industries (JHX) Stock Outpacing Its Construction Peers This Year?Here is how James Hardie (JHX) and Lennar (LEN) have performed compared to their sector so far this year. |

JHX Price Returns

| 1-mo | 10.25% |

| 3-mo | -2.74% |

| 6-mo | -4.49% |

| 1-year | 22.19% |

| 3-year | 5.55% |

| 5-year | 159.34% |

| YTD | -9.28% |

| 2023 | 115.55% |

| 2022 | -55.54% |

| 2021 | 38.18% |

| 2020 | 51.02% |

| 2019 | 70.78% |

Continue Researching JHX

Want to see what other sources are saying about James Hardie Industries plc's financials and stock price? Try the links below:James Hardie Industries plc (JHX) Stock Price | Nasdaq

James Hardie Industries plc (JHX) Stock Quote, History and News - Yahoo Finance

James Hardie Industries plc (JHX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...