Kaman Corporation (KAMN): Price and Financial Metrics

KAMN Price/Volume Stats

| Current price | $45.99 | 52-week high | $46.00 |

| Prev. close | $45.87 | 52-week low | $18.06 |

| Day low | $45.88 | Volume | 1,407,700 |

| Day high | $46.00 | Avg. volume | 364,352 |

| 50-day MA | $45.69 | Dividend yield | 1.74% |

| 200-day MA | $29.14 | Market Cap | 1.30B |

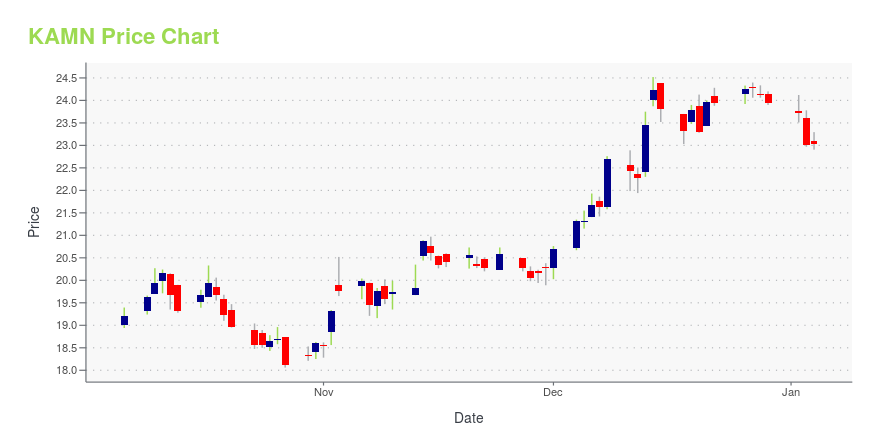

KAMN Stock Price Chart Interactive Chart >

Kaman Corporation (KAMN) Company Bio

Kaman Corporation produces and/or markets widely used proprietary aircraft bearings and components; complex metallic and composite aerostructures for commercial, military and general aviation fixed and rotary wing aircraft; aerostructure engineering design analysis and FAA certification services; safe and arm solutions for missile and bomb systems for the U.S. and allied militaries; K-MAX® medium to heavy lift helicopters; and support for the company's SH-2G Super Seasprite maritime helicopters and K-MAX® aircraft. The company was founded in 1945 and is based in Bloomfield, Connecticut.

Latest KAMN News From Around the Web

Below are the latest news stories about KAMAN CORP that investors may wish to consider to help them evaluate KAMN as an investment opportunity.

Jim Cramer Stock Portfolio: 12 Recent AdditionsIn this article, we discuss the 12 recent additions to the Jim Cramer stock portfolio. If you want to read about some more Cramer stocks, go directly to Jim Cramer Stock Portfolio: 5 Recent Additions. Jim Cramer, the host of Mad Money on CNBC, is one of the most well-known finance personalities on television. He […] |

Kaman's (NYSE:KAMN) Dividend Will Be $0.20Kaman Corporation's ( NYSE:KAMN ) investors are due to receive a payment of $0.20 per share on 11th of January. Based... |

Kaman (NYSE:KAMN) Has Announced A Dividend Of $0.20The board of Kaman Corporation ( NYSE:KAMN ) has announced that it will pay a dividend of $0.20 per share on the 11th... |

Should You Investigate Kaman Corporation (NYSE:KAMN) At US$20.34?While Kaman Corporation ( NYSE:KAMN ) might not be the most widely known stock at the moment, it saw a decent share... |

Kaman Board of Directors Declares DividendBLOOMFIELD, Conn., November 15, 2023--(NYSE:KAMN) The Kaman Corporation board of directors declared a regular quarterly dividend of 20 cents per common share. The dividend will be paid on January 11, 2024, to shareholders of record on December 19, 2023. |

KAMN Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | 2.65% |

| 1-year | 109.79% |

| 3-year | 11.32% |

| 5-year | -19.02% |

| YTD | 92.86% |

| 2023 | 11.39% |

| 2022 | -46.89% |

| 2021 | -23.10% |

| 2020 | -11.76% |

| 2019 | 19.06% |

KAMN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching KAMN

Want to do more research on KAMAN Corp's stock and its price? Try the links below:KAMAN Corp (KAMN) Stock Price | Nasdaq

KAMAN Corp (KAMN) Stock Quote, History and News - Yahoo Finance

KAMAN Corp (KAMN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...