KKR & Co. Inc. (KKR): Price and Financial Metrics

KKR Price/Volume Stats

| Current price | $147.24 | 52-week high | $170.40 |

| Prev. close | $141.57 | 52-week low | $86.15 |

| Day low | $142.14 | Volume | 3,026,800 |

| Day high | $148.10 | Avg. volume | 4,930,737 |

| 50-day MA | $135.97 | Dividend yield | 0.52% |

| 200-day MA | $0.00 | Market Cap | 131.18B |

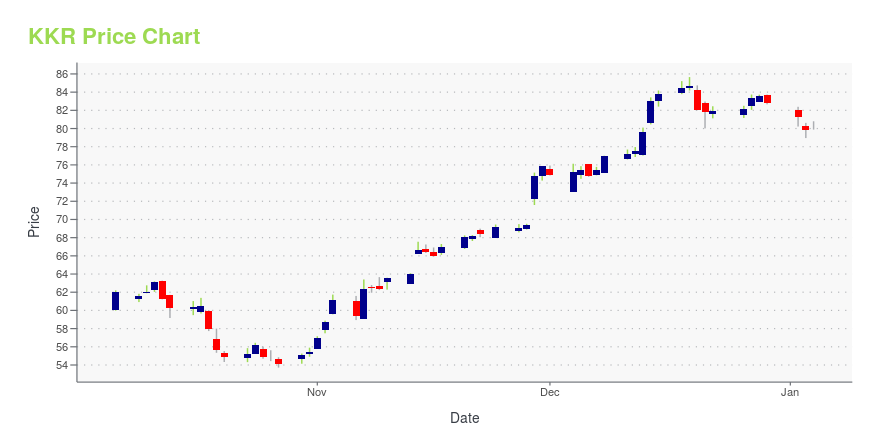

KKR Stock Price Chart Interactive Chart >

KKR & Co. Inc. (KKR) Company Bio

KKR & Co. Inc., also known as Kohlberg Kravis Roberts & Co., is an American global investment company that manages multiple alternative asset classes, including private equity, energy, infrastructure, real estate, credit, and, through its strategic partners, hedge funds. As of December 31, 2021, the firm had completed more than 650 private equity investments in portfolio companies with approximately $675 billion of total enterprise value. As of December 31, 2021, assets under management ("AUM") and fee paying assets under management ("FPAUM") were $471 billion and $357 billion, respectively. (Source:Wikipedia)

KKR Price Returns

| 1-mo | 5.74% |

| 3-mo | 17.34% |

| 6-mo | 5.05% |

| 1-year | 27.83% |

| 3-year | 164.92% |

| 5-year | 322.10% |

| YTD | -0.04% |

| 2024 | 79.65% |

| 2023 | 80.48% |

| 2022 | -36.81% |

| 2021 | 85.76% |

| 2020 | 41.13% |

KKR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching KKR

Here are a few links from around the web to help you further your research on KKR & Co Inc's stock as an investment opportunity:KKR & Co Inc (KKR) Stock Price | Nasdaq

KKR & Co Inc (KKR) Stock Quote, History and News - Yahoo Finance

KKR & Co Inc (KKR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...