KKR & Co. Inc. (KKR): Price and Financial Metrics

KKR Price/Volume Stats

| Current price | $118.51 | 52-week high | $120.14 |

| Prev. close | $116.71 | 52-week low | $53.72 |

| Day low | $118.04 | Volume | 3,480,300 |

| Day high | $120.14 | Avg. volume | 4,936,669 |

| 50-day MA | $108.19 | Dividend yield | 0.59% |

| 200-day MA | $90.25 | Market Cap | 105.17B |

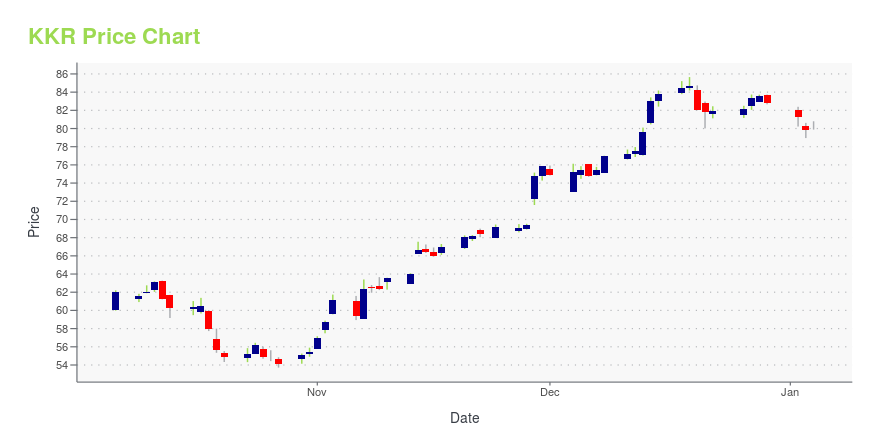

KKR Stock Price Chart Interactive Chart >

KKR & Co. Inc. (KKR) Company Bio

KKR & Co. Inc., also known as Kohlberg Kravis Roberts & Co., is an American global investment company that manages multiple alternative asset classes, including private equity, energy, infrastructure, real estate, credit, and, through its strategic partners, hedge funds. As of December 31, 2021, the firm had completed more than 650 private equity investments in portfolio companies with approximately $675 billion of total enterprise value. As of December 31, 2021, assets under management ("AUM") and fee paying assets under management ("FPAUM") were $471 billion and $357 billion, respectively. (Source:Wikipedia)

Latest KKR News From Around the Web

Below are the latest news stories about KKR & CO INC that investors may wish to consider to help them evaluate KKR as an investment opportunity.

3 Asset Managers Set to Continue Their Winning Streak in 2024Despite the tough operating backdrop, KKR, Apollo Global (APO) and Victory Capital (VCTR) remain poised for AUM growth in 2024, supported by decent asset inflows. |

KKR Announces Intra-Quarter Monetization Activity Update for the Fourth QuarterNEW YORK, December 21, 2023--KKR today announced a monetization activity update for the period from October 1, 2023 to December 21, 2023. Based on information available to us as of today, with respect to the period through December 21, 2023, KKR has earned total realized performance income, including realized incentive fees, and total realized investment income in excess of $500 million. Our monetization activity quarter-to-date is made up of approximately 70% gross realized carried interest and |

KKR Launches €1.2 Billion Bid for Portugal Energy Firm Greenvolt(Bloomberg) -- A fund controlled by KKR & Co. has offered to buy Portugal’s Greenvolt-Energias Renovaveis SA for €1.2 billion ($1.3 billion) in an effort to expand its presence in renewable energy.Most Read from BloombergVilified Zero-Day Options Blamed by Traders for S&P DeclineHarvard Financial Pain Grows as Blavatnik Joins Donor RevoltUS Inflation Report to Show Fed’s Battle Is Now All But CompleteGiuliani Files for Bankruptcy After $148 Million Defamation LossUS Stocks Cling to Gains as Trea |

What to Do Now if You’re Late to the Stock RallyMany investors who have been ensconced in the relative safety of bonds that yield 5% or so are increasingly wondering if they’ve missed out. Here’s what they should consider. |

Goldman Leads $1.4 Billion Private Loan for EQT’s Zeus Buyout(Bloomberg) -- A group of private credit lenders led by Goldman Sachs Group Inc.’s asset management division has agreed to provide $1.425 billion of debt to help EQT AB finance its acquisition of medical device firm Zeus Company Inc., according to people familiar with the matter.Most Read from BloombergTrump Barred From Colorado Ballot in Unprecedented RulingApple Races to Tweak Software Ahead of Looming US Watch BanThe Hedge Fund Traders Dominating a Massive Bet on BondsApple to Halt US Sales o |

KKR Price Returns

| 1-mo | 12.03% |

| 3-mo | 24.26% |

| 6-mo | 37.08% |

| 1-year | 102.17% |

| 3-year | 96.47% |

| 5-year | 362.79% |

| YTD | 43.53% |

| 2023 | 80.48% |

| 2022 | -36.81% |

| 2021 | 85.76% |

| 2020 | 41.13% |

| 2019 | 51.57% |

KKR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching KKR

Here are a few links from around the web to help you further your research on KKR & Co Inc's stock as an investment opportunity:KKR & Co Inc (KKR) Stock Price | Nasdaq

KKR & Co Inc (KKR) Stock Quote, History and News - Yahoo Finance

KKR & Co Inc (KKR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...