Kite Realty Group Trust (KRG): Price and Financial Metrics

KRG Price/Volume Stats

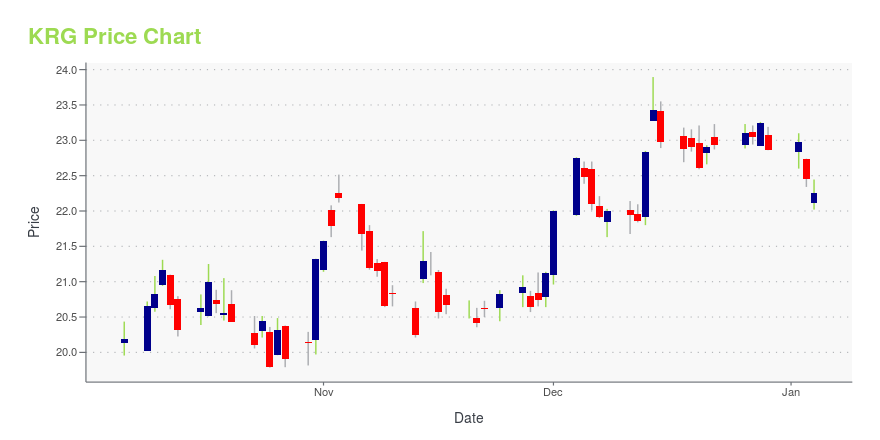

| Current price | $24.06 | 52-week high | $24.26 |

| Prev. close | $23.67 | 52-week low | $19.64 |

| Day low | $23.69 | Volume | 1,192,684 |

| Day high | $24.13 | Avg. volume | 1,658,575 |

| 50-day MA | $22.22 | Dividend yield | 4.15% |

| 200-day MA | $21.57 | Market Cap | 5.28B |

KRG Stock Price Chart Interactive Chart >

Kite Realty Group Trust (KRG) Company Bio

Kite Realty Group is a full-service, vertically integrated real estate investment trust engaged in the ownership, operation, management, leasing, acquisition, construction, redevelopment and development of neighborhood and community shopping centers in selected markets in the United States. The company was founded in 1968 and is based in Indianapolis, Indiana.

Latest KRG News From Around the Web

Below are the latest news stories about KITE REALTY GROUP TRUST that investors may wish to consider to help them evaluate KRG as an investment opportunity.

Kite Realty Group (KRG) Now Trades Above Golden Cross: Time to Buy?Good things could be on the horizon when a stock experiences a golden cross event. How should investors react? |

Improve Your Retirement Income with These 3 Top-Ranked Dividend StocksThe traditional ways to plan for your retirement may mean income can no longer cover expenses post-employment. But what if there was another option that could provide a steady, reliable source of income in your nest egg years? |

Nordstrom Rack to Open New Location in Franklin, TennesseeSeattle-based fashion retailer Nordstrom, Inc. (NYSE: JWN) announced plans to open a new Nordstrom Rack in Franklin, Tennessee in fall 2024. |

The 7 Best REITs Stocks to Buy in DecemberInvest in the these seven best REITs to buy offering strong upside and shining bright in 2023's tough real estate market. |

How to Maximize Your Retirement Portfolio with These Top-Ranked Dividend StocksThe traditional ways to plan for your retirement may mean income can no longer cover expenses post-employment. But what if there was another option that could provide a steady, reliable source of income in your nest egg years? |

KRG Price Returns

| 1-mo | 11.93% |

| 3-mo | 14.46% |

| 6-mo | 13.66% |

| 1-year | 10.72% |

| 3-year | 36.96% |

| 5-year | 94.85% |

| YTD | 8.96% |

| 2023 | 13.60% |

| 2022 | 0.80% |

| 2021 | 50.80% |

| 2020 | -20.04% |

| 2019 | 53.18% |

KRG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching KRG

Want to do more research on Kite Realty Group Trust's stock and its price? Try the links below:Kite Realty Group Trust (KRG) Stock Price | Nasdaq

Kite Realty Group Trust (KRG) Stock Quote, History and News - Yahoo Finance

Kite Realty Group Trust (KRG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...