Gladstone Land Corporation (LAND): Price and Financial Metrics

LAND Price/Volume Stats

| Current price | $14.98 | 52-week high | $17.22 |

| Prev. close | $14.85 | 52-week low | $12.31 |

| Day low | $14.74 | Volume | 134,392 |

| Day high | $15.03 | Avg. volume | 187,662 |

| 50-day MA | $13.79 | Dividend yield | 3.7% |

| 200-day MA | $13.70 | Market Cap | 536.85M |

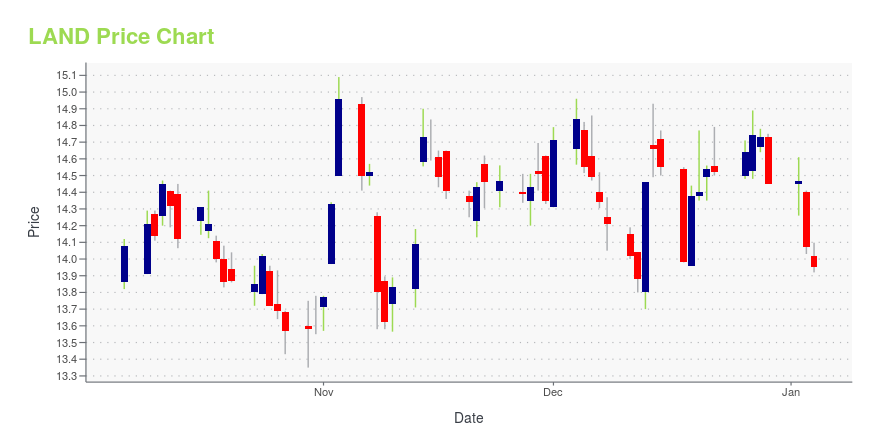

LAND Stock Price Chart Interactive Chart >

Gladstone Land Corporation (LAND) Company Bio

Gladstone Land Corporation, an externally-managed agricultural real estate investment trust, owns and leases farmland for independent and corporate farming operations in the United States. The company was founded in 1997 and is based in McLean, Virginia.

Latest LAND News From Around the Web

Below are the latest news stories about GLADSTONE LAND CORP that investors may wish to consider to help them evaluate LAND as an investment opportunity.

Gladstone Land Corporation (NASDAQ:LAND) Q3 2023 Earnings Call TranscriptGladstone Land Corporation (NASDAQ:LAND) Q3 2023 Earnings Call Transcript November 8, 2023 Operator: Greetings and welcome to the Gladstone Land Corporation Third Quarter Earnings Conference Call. [Operator Instructions] As a reminder, this conference is being recorded. It is now my pleasure to introduce your host, Mr. David Gladstone, Chief Executive Officer. Please proceed, sir. David […] |

Gladstone Land Announces Third Quarter 2023 ResultsPlease note that the limited information that follows in this press release is a summary and is not adequate for making an informed investment decision.MCLEAN, VA / ACCESSWIRE / November 7, 2023 / Gladstone Land Corporation (Nasdaq:LAND) ("Gladstone ... |

Gladstone Land Corporation Earnings Call and Webcast InformationMCLEAN, VA / ACCESSWIRE / November 6, 2023 / Gladstone Land Corporation (Nasdaq:LAND) announces the following event:What:Gladstone Land Corporation's Third Quarter Ended September 30, 2023, Earnings Call & WebcastWhen:Wednesday, November 8, 2023 @ ... |

Monthly Passive Income: 3 Growth Stocks Worth ConsideringConsider these three solid growth stocks for monthly passive income and enjoy steady dividends for years to come. |

Peapack-Gladstone (PGC) Misses Q3 Earnings EstimatesPeapack-Gladstone (PGC) delivered earnings and revenue surprises of -18.03% and 1.81%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

LAND Price Returns

| 1-mo | 13.50% |

| 3-mo | 19.35% |

| 6-mo | 8.66% |

| 1-year | -4.73% |

| 3-year | -30.47% |

| 5-year | 52.63% |

| YTD | 6.24% |

| 2023 | -18.50% |

| 2022 | -44.42% |

| 2021 | 136.25% |

| 2020 | 17.37% |

| 2019 | 17.65% |

LAND Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LAND

Want to do more research on GLADSTONE LAND Corp's stock and its price? Try the links below:GLADSTONE LAND Corp (LAND) Stock Price | Nasdaq

GLADSTONE LAND Corp (LAND) Stock Quote, History and News - Yahoo Finance

GLADSTONE LAND Corp (LAND) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...