Lennar Corp. CI A (LEN): Price and Financial Metrics

LEN Price/Volume Stats

| Current price | $109.43 | 52-week high | $193.80 |

| Prev. close | $107.73 | 52-week low | $98.42 |

| Day low | $107.46 | Volume | 2,874,302 |

| Day high | $110.31 | Avg. volume | 3,220,109 |

| 50-day MA | $109.57 | Dividend yield | 1.77% |

| 200-day MA | $133.98 | Market Cap | 28.34B |

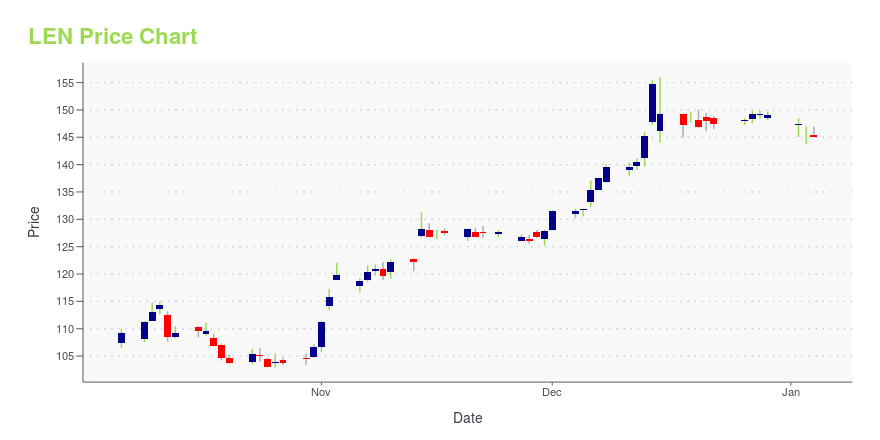

LEN Stock Price Chart Interactive Chart >

Lennar Corp. CI A (LEN) Company Bio

Lennar Corporation is a home construction and real estate company based in Fontainebleau, Florida, with a Miami postal address. In 2017, the company was the largest home construction company in the United States after its purchase of CalAtlantic Homes. The company is ranked 154th on the Fortune 500 as of 2019. The company operates in 21 states and owns Rialto Capital Management, the sponsor of six private equity funds that invest in real estate and an originator commercial mortgage loans for securitization. The company also developed and retains ownership interests in 53 apartment communities. The name Lennar is a portmanteau of the first names of two of the company's founders, Leonard Miller and Arnold Rosen. (Source:Wikipedia)

LEN Price Returns

| 1-mo | 0.38% |

| 3-mo | 5.43% |

| 6-mo | -13.92% |

| 1-year | -27.98% |

| 3-year | 60.94% |

| 5-year | 85.53% |

| YTD | -10.66% |

| 2024 | -7.32% |

| 2023 | 66.92% |

| 2022 | -20.64% |

| 2021 | 53.99% |

| 2020 | 37.97% |

LEN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LEN

Want to do more research on Lennar Corp's stock and its price? Try the links below:Lennar Corp (LEN) Stock Price | Nasdaq

Lennar Corp (LEN) Stock Quote, History and News - Yahoo Finance

Lennar Corp (LEN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...