Laboratory Corp. of America Holdings (LH): Price and Financial Metrics

LH Price/Volume Stats

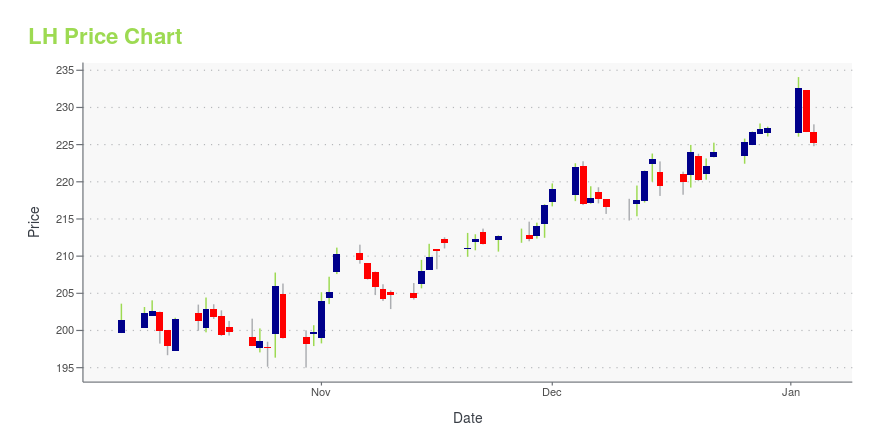

| Current price | $198.40 | 52-week high | $234.09 |

| Prev. close | $198.35 | 52-week low | $174.20 |

| Day low | $197.01 | Volume | 931,300 |

| Day high | $200.16 | Avg. volume | 758,681 |

| 50-day MA | $211.77 | Dividend yield | 1.38% |

| 200-day MA | $213.06 | Market Cap | 16.69B |

LH Stock Price Chart Interactive Chart >

Laboratory Corp. of America Holdings (LH) Company Bio

Laboratory Corporation of America Holdings, more commonly known as Labcorp, is an American S&P 500 company headquartered in Burlington, North Carolina. It operates one of the largest clinical laboratory networks in the world, with a United States network of 36 primary laboratories. Before a merger with National Health Laboratory in 1995, the company operated under the name Roche BioMedical. Labcorp performs its largest volume of specialty testing at its Center for Esoteric Testing in Burlington, North Carolina, where the company is headquartered. As of 2018, Labcorp processes 2.5 million lab tests weekly. (Source:Wikipedia)

Latest LH News From Around the Web

Below are the latest news stories about LABORATORY CORP OF AMERICA HOLDINGS that investors may wish to consider to help them evaluate LH as an investment opportunity.

Should You Invest in Laboratory Corporation of America Holdings (LH)?Diamond Hill Capital, an investment management company, released its “Long-Short Fund” third-quarter 2023 investor letter. A copy of the same can be downloaded here. The positive returns of the portfolio outperformed the Russell 1000 Index and the blended benchmark (60% Russell 1000 Index/40% Bloomberg US Treasury Bills 1-3 Month Index), both of which were negative in […] |

An Intrinsic Calculation For Laboratory Corporation of America Holdings (NYSE:LH) Suggests It's 43% UndervaluedKey Insights Using the 2 Stage Free Cash Flow to Equity, Laboratory Corporation of America Holdings fair value estimate... |

Healthcare Sector Stocks: Consistent Above-Average Growth And IncomeThe healthcare sector is full of many really good companies with consistent, long term, above-average growth rates and many that have good, consistent, long-term dividend records. |

11 Recent Spin-off Companies That Hedge Funds Are Piling IntoIn this article, we discuss the 11 recent spin-off companies that hedge funds are piling into. To skip the detailed analysis of spin-off companies and their recent performance, go directly to the 5 Recent Spin-off Companies That Hedge Funds Are Piling Into. A spin-off is a process that involves a company separating a part of […] |

Here's Why Investors Should Retain Labcorp (LH) Stock for NowInvestors are increasingly optimistic about Labcorp (LH) due to development in targeted high-growth areas. |

LH Price Returns

| 1-mo | -9.18% |

| 3-mo | -11.50% |

| 6-mo | 0.80% |

| 1-year | 6.43% |

| 3-year | -7.09% |

| 5-year | 56.99% |

| YTD | -12.42% |

| 2023 | 17.34% |

| 2022 | -24.41% |

| 2021 | 54.37% |

| 2020 | 20.32% |

| 2019 | 33.88% |

LH Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LH

Here are a few links from around the web to help you further your research on Laboratory Corp Of America Holdings's stock as an investment opportunity:Laboratory Corp Of America Holdings (LH) Stock Price | Nasdaq

Laboratory Corp Of America Holdings (LH) Stock Quote, History and News - Yahoo Finance

Laboratory Corp Of America Holdings (LH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...