LivaNova PLC - Ordinary Shares (LIVN): Price and Financial Metrics

LIVN Price/Volume Stats

| Current price | $53.61 | 52-week high | $64.47 |

| Prev. close | $53.45 | 52-week low | $42.75 |

| Day low | $53.03 | Volume | 409,100 |

| Day high | $53.99 | Avg. volume | 644,558 |

| 50-day MA | $55.52 | Dividend yield | N/A |

| 200-day MA | $52.51 | Market Cap | 2.90B |

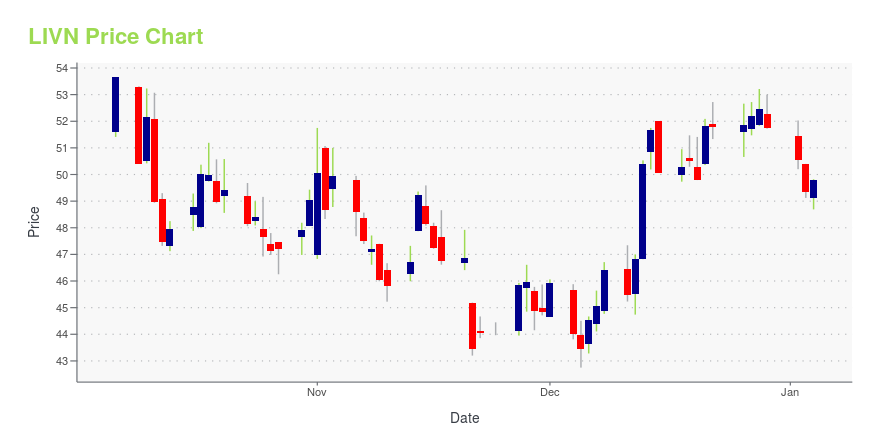

LIVN Stock Price Chart Interactive Chart >

LivaNova PLC - Ordinary Shares (LIVN) Company Bio

LivaNova PLC. offers cardiac surgery, cardiac rhythm management, and neuromodulation related products worldwide. The company was founded in 1987 and is based in London, England.

Latest LIVN News From Around the Web

Below are the latest news stories about LIVANOVA PLC that investors may wish to consider to help them evaluate LIVN as an investment opportunity.

Is Now The Time To Look At Buying LivaNova PLC (NASDAQ:LIVN)?While LivaNova PLC ( NASDAQ:LIVN ) might not be the most widely known stock at the moment, it received a lot of... |

Billionaire David Einhorn’s 10 Stock Picks with Huge Upside PotentialIn this article, we will take a look at billionaire David Einhorn’s 10 stock picks with huge upside potential. To skip our analysis of David Einhorn’s investment strategy and Greenlight Capital’s previous performance, you can go directly to see the Billionaire David Einhorn’s 5 Stock Picks with Huge Upside Potential. David Einhorn is a renowned […] |

LivaNova warns cybersecurity incident disrupts systems, takes steps to limit impactThe medical device maker warned that the incident is expected to continue to disrupt its business operations. |

15 Stocks Billionaire David Einhorn Just Bought and SoldIn this article, we will take a look at the 15 stocks billionaire David Einhorn just bought and sold. To see more such companies, go directly to 5 Stocks Billionaire David Einhorn Just Bought and Sold. David Einhorn is a notable American hedge fund manager who is known for beating the stock market for a […] |

A Look At The Intrinsic Value Of LivaNova PLC (NASDAQ:LIVN)Key Insights The projected fair value for LivaNova is US$44.38 based on 2 Stage Free Cash Flow to Equity LivaNova's... |

LIVN Price Returns

| 1-mo | -1.58% |

| 3-mo | -3.46% |

| 6-mo | 8.22% |

| 1-year | -6.46% |

| 3-year | -34.64% |

| 5-year | -26.56% |

| YTD | 3.61% |

| 2023 | -6.84% |

| 2022 | -36.47% |

| 2021 | 32.05% |

| 2020 | -12.22% |

| 2019 | -17.54% |

Continue Researching LIVN

Want to do more research on LivaNova PLC's stock and its price? Try the links below:LivaNova PLC (LIVN) Stock Price | Nasdaq

LivaNova PLC (LIVN) Stock Quote, History and News - Yahoo Finance

LivaNova PLC (LIVN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...