Lakeland Financial Corporation (LKFN): Price and Financial Metrics

LKFN Price/Volume Stats

| Current price | $71.18 | 52-week high | $73.22 |

| Prev. close | $70.75 | 52-week low | $44.47 |

| Day low | $69.91 | Volume | 129,300 |

| Day high | $72.00 | Avg. volume | 120,182 |

| 50-day MA | $62.45 | Dividend yield | 2.71% |

| 200-day MA | $61.03 | Market Cap | 1.82B |

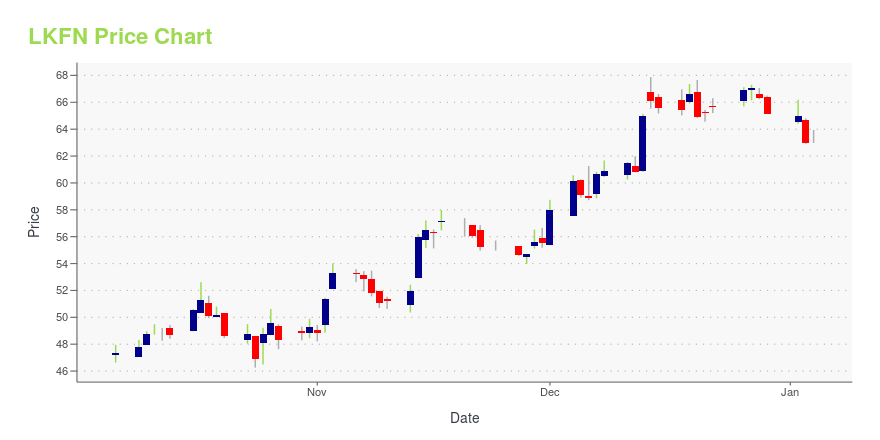

LKFN Stock Price Chart Interactive Chart >

Lakeland Financial Corporation (LKFN) Company Bio

Lakeland Financial Corporation operates as the holding company for Lake City Bank that provides various financial services to individuals and businesses in Indiana. The company was founded in 1872 and is based in Warsaw, Indiana.

Latest LKFN News From Around the Web

Below are the latest news stories about LAKELAND FINANCIAL CORP that investors may wish to consider to help them evaluate LKFN as an investment opportunity.

Macatawa (MCBC) Surges 5.1%: Is This an Indication of Further Gains?Macatawa (MCBC) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road. |

Lakeland Financial (NASDAQ:LKFN) investors are sitting on a loss of 27% if they invested a year agoLakeland Financial Corporation ( NASDAQ:LKFN ) shareholders should be happy to see the share price up 15% in the last... |

David M. Findlay Appointed Chairman of the Board of Lake City Bank and Lakeland Financial CorporationWARSAW, Ind., Nov. 14, 2023 (GLOBE NEWSWIRE) -- Lakeland Financial Corporation (Nasdaq Global Select/LKFN), and Lake City Bank announced today that David M. Findlay has been appointed as Chairman of the Board of the bank and holding company. Findlay will assume the role of Chairman in addition to his current responsibilities as Chief Executive Officer of both organizations. Findlay succeeds Michael L. Kubacki as Chairman of the board of both organizations. Kubacki has served in the role since 20 |

Lakeland Financial Insiders Added US$3.98m Of Stock To Their HoldingsIn the last year, multiple insiders have substantially increased their holdings of Lakeland Financial Corporation... |

Lakeland Financial (LKFN) Reports Q3 Earnings: What Key Metrics Have to SayWhile the top- and bottom-line numbers for Lakeland Financial (LKFN) give a sense of how the business performed in the quarter ended September 2023, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values. |

LKFN Price Returns

| 1-mo | 20.06% |

| 3-mo | 19.92% |

| 6-mo | -1.01% |

| 1-year | 31.11% |

| 3-year | 17.64% |

| 5-year | 81.58% |

| YTD | 11.68% |

| 2023 | -7.78% |

| 2022 | -7.00% |

| 2021 | 52.73% |

| 2020 | 12.55% |

| 2019 | 24.99% |

LKFN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LKFN

Want to see what other sources are saying about Lakeland Financial Corp's financials and stock price? Try the links below:Lakeland Financial Corp (LKFN) Stock Price | Nasdaq

Lakeland Financial Corp (LKFN) Stock Quote, History and News - Yahoo Finance

Lakeland Financial Corp (LKFN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...