Brasilagro Brazilian Agric Real Estate Co Sponsored ADR (Brazil) (LND): Price and Financial Metrics

LND Price/Volume Stats

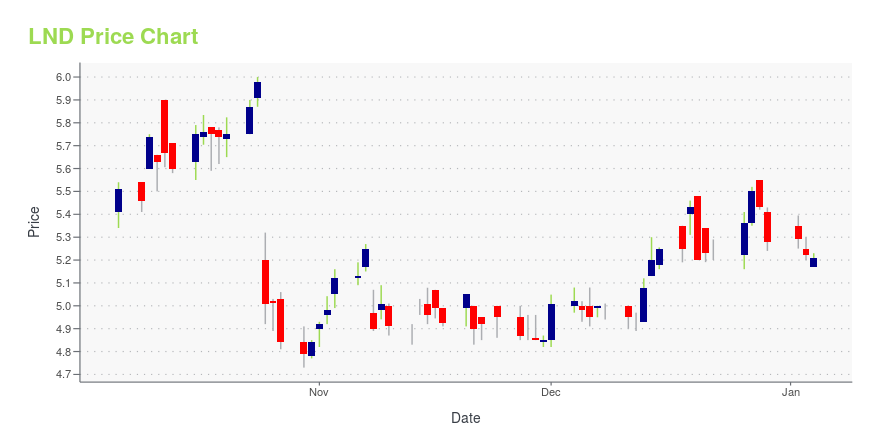

| Current price | $4.77 | 52-week high | $6.00 |

| Prev. close | $4.68 | 52-week low | $4.54 |

| Day low | $4.67 | Volume | 49,418 |

| Day high | $4.79 | Avg. volume | 39,003 |

| 50-day MA | $4.81 | Dividend yield | 13.11% |

| 200-day MA | $4.97 | Market Cap | 489.80M |

LND Stock Price Chart Interactive Chart >

Brasilagro Brazilian Agric Real Estate Co Sponsored ADR (Brazil) (LND) Company Bio

BrasilAgro Companhia Brasileira de Propriedades Agrícolas engages in the agriculture, cattle raising, and forestry activities in Brazil. The company operates through five segments: Real Estate, Grains, Sugarcane, Cattle Raising, and Other. The company was founded in 2005 and is based in São Paulo, Brazil.

Latest LND News From Around the Web

Below are the latest news stories about BRASILAGRO - BRAZILIAN AGRICULTURAL REAL ESTATE CO that investors may wish to consider to help them evaluate LND as an investment opportunity.

Brasilagro Brazilian Agric Real Estate Co Sponsored ADR (Brazil) (NYSE:LND) Q2 2023 Earnings Call TranscriptBrasilagro Brazilian Agric Real Estate Co Sponsored ADR (Brazil) (NYSE:LND) Q2 2023 Earnings Call Transcript February 8, 2023 Ana Ribeiro: Good afternoon to all. We have a lot of people connected to hear our results. My name is Ana Ribeiro, Head of Investor Relations at BrasilAgro. We’re here to talk about the earnings in Q1, […] |

LND Price Returns

| 1-mo | 1.92% |

| 3-mo | -3.64% |

| 6-mo | -6.47% |

| 1-year | -3.32% |

| 3-year | 18.80% |

| 5-year | 67.70% |

| YTD | -9.66% |

| 2023 | 3.82% |

| 2022 | 22.20% |

| 2021 | 16.71% |

| 2020 | 7.85% |

| 2019 | 24.62% |

LND Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LND

Want to see what other sources are saying about BrasilAgr's financials and stock price? Try the links below:BrasilAgr (LND) Stock Price | Nasdaq

BrasilAgr (LND) Stock Quote, History and News - Yahoo Finance

BrasilAgr (LND) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...