Alliant Energy Corp. (LNT): Price and Financial Metrics

LNT Price/Volume Stats

| Current price | $56.01 | 52-week high | $56.79 |

| Prev. close | $55.84 | 52-week low | $45.15 |

| Day low | $55.67 | Volume | 1,263,400 |

| Day high | $56.20 | Avg. volume | 1,727,432 |

| 50-day MA | $51.78 | Dividend yield | 3.51% |

| 200-day MA | $50.16 | Market Cap | 14.36B |

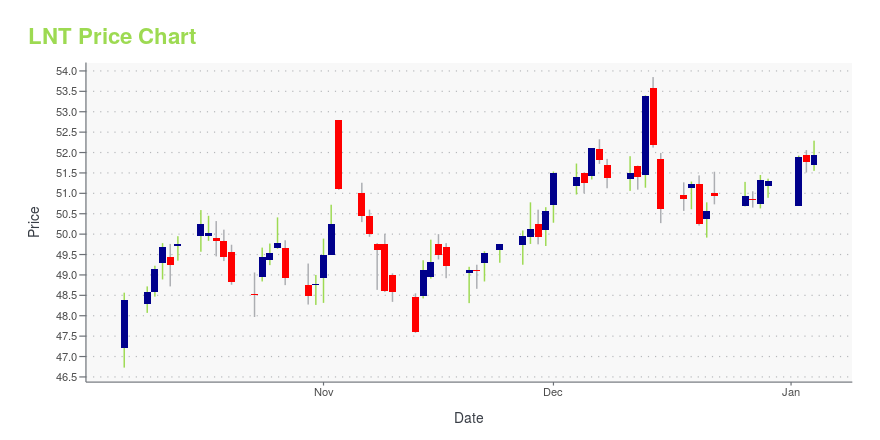

LNT Stock Price Chart Interactive Chart >

Alliant Energy Corp. (LNT) Company Bio

Alliant Energyis a public utility holding company headquartered in Madison, Wisconsin, providing power in Iowa and Wisconsin. (Source:Wikipedia)

Latest LNT News From Around the Web

Below are the latest news stories about ALLIANT ENERGY CORP that investors may wish to consider to help them evaluate LNT as an investment opportunity.

Alliant Energy (NASDAQ:LNT) Hasn't Managed To Accelerate Its ReturnsIf we want to find a stock that could multiply over the long term, what are the underlying trends we should look for... |

Reasons to Add Alliant Energy (LNT) to Your Portfolio NowAlliant Energy (LNT) continues to serve its customers efficiently and is making significant investments to strengthen its existing operations further. |

Alliant, DTE, NextEra, others urge FERC to reject MISO’s proposed interconnection queue capThe grid operator’s proposed interconnection study cap would create “an unworkable queue that undermines competition, raises rates, and threatens reliability,” renewable energy groups said Monday. |

Alliant Energy (LNT) to Gain From Investments, Clean PortfolioAlliant Energy (LNT) will continue to benefit from its initiative to strengthen and expand its infrastructure, and its focus on adding clean assets to its portfolio. |

Mairs and Power Bolsters Position in Alliant Energy Corp with a 0.93% Portfolio ImpactInsight into Mairs and Power (Trades, Portfolio)'s Q3 2023 Investment Moves and Portfolio Adjustments |

LNT Price Returns

| 1-mo | 11.00% |

| 3-mo | 14.05% |

| 6-mo | 16.92% |

| 1-year | 6.60% |

| 3-year | 3.41% |

| 5-year | 31.38% |

| YTD | 11.33% |

| 2023 | -3.85% |

| 2022 | -7.44% |

| 2021 | 22.86% |

| 2020 | -3.16% |

| 2019 | 33.43% |

LNT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LNT

Want to see what other sources are saying about Alliant Energy Corp's financials and stock price? Try the links below:Alliant Energy Corp (LNT) Stock Price | Nasdaq

Alliant Energy Corp (LNT) Stock Quote, History and News - Yahoo Finance

Alliant Energy Corp (LNT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...