Lake Shore Bancorp, Inc. (LSBK): Price and Financial Metrics

LSBK Price/Volume Stats

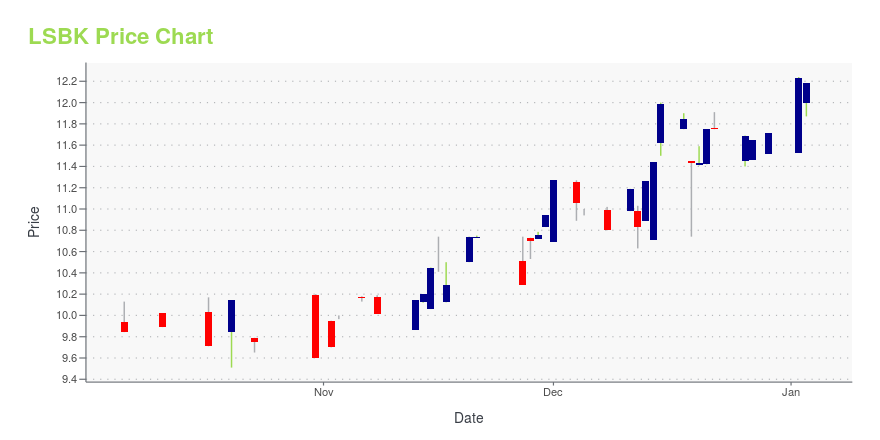

| Current price | $12.58 | 52-week high | $13.15 |

| Prev. close | $12.55 | 52-week low | $9.51 |

| Day low | $12.58 | Volume | 200 |

| Day high | $12.58 | Avg. volume | 2,193 |

| 50-day MA | $12.21 | Dividend yield | 1.43% |

| 200-day MA | $11.25 | Market Cap | 72.17M |

LSBK Stock Price Chart Interactive Chart >

Lake Shore Bancorp, Inc. (LSBK) Company Bio

Lake Shore Bancorp, Inc. operates as the savings and loan holding company for Lake Shore Savings Bank that provides retail and commercial banking products and services. It accepts various deposit products, such as regular savings deposits, including Christmas Club, passbook, and statement savings accounts; money market savings and checking accounts; interest bearing and non-interest bearing checking accounts comprising demand deposits; health savings accounts; retirement accounts; time deposits; interest on lawyer accounts; and accounts for individuals, as well as commercial savings, checking, and money market accounts for businesses. The company's loan portfolio consists of one-to four-family residential mortgages, home equity loans, commercial real estate loans, and construction loans; business installment loans, lines of credit, and other commercial loans; and consumer loans that include personal consumer loans, overdraft lines of credit, vehicle loans, secured and unsecured property improvement loans, and other secured and unsecured loans. As of February 6, 2020, it had 11 full-service branch locations in Western New York, including 5 locations in Chautauqua County and 6 locations in Erie County, New York. The company was founded in 1891 and is headquartered in Dunkirk, New York. Lake Shore Bancorp, Inc. is a subsidiary of Lake Shore, MHC.

Latest LSBK News From Around the Web

Below are the latest news stories about LAKE SHORE BANCORP INC that investors may wish to consider to help them evaluate LSBK as an investment opportunity.

Lake Shore Bancorp Inc (LSBK) Reports Q3 2023 EarningsNet income decreases by 11.3% compared to Q3 2022 |

Lake Shore Bancorp, Inc. Announces 2023 Third Quarter Financial ResultsDUNKIRK, N.Y., Oct. 26, 2023 (GLOBE NEWSWIRE) -- Lake Shore Bancorp, Inc. (the “Company”) (NASDAQ: LSBK), the holding company for Lake Shore Savings Bank (the “Bank”), reported unaudited net income of $1.6 million, or $0.27 per diluted share, for the 2023 third quarter compared to net income of $1.8 million, or $0.30 per diluted share, for the 2022 third quarter. For the first nine months of 2023, the Company reported unaudited net income of $4.1 million, or $0.69 per diluted share, as compared |

The past five years for Lake Shore Bancorp (NASDAQ:LSBK) investors has not been profitableFor many, the main point of investing is to generate higher returns than the overall market. But in any portfolio... |

Lake Shore Bancorp Appoints Taylor Gilden as Chief Financial Officer; Names Rachel Foley Chief Operating OfficerLake Shore Bancorp Appoints Taylor Gilden as Chief Financial Officer; Names Rachel Foley Chief Operating Officer Taylor Gilden (left) and Rachel Foley (right) Taylor Gilden (left) and Rachel Foley (right) DUNKIRK, N.Y., Aug. 02, 2023 (GLOBE NEWSWIRE) -- Lake Shore Bancorp, Inc. (the “Company”), its wholly-owned subsidiary, Lake Shore Savings Bank (the “Bank”), and Lake Shore, MHC (the “MHC”), appointed Taylor Gilden as Chief Financial Officer (“CFO”) and Treasurer and Rachel Foley as Chief Opera |

Lake Shore Bancorp, Inc. Announces 2023 Second Quarter Financial ResultsDUNKIRK, N.Y., July 27, 2023 (GLOBE NEWSWIRE) -- Lake Shore Bancorp, Inc. (the “Company”) (NASDAQ: LSBK), the holding company for Lake Shore Savings Bank (the “Bank”), reported unaudited net income of $0.8 million, or $0.14 per diluted share, for the 2023 second quarter compared to net income of $1.7 million, or $0.29 per diluted share, for the 2022 second quarter. For the first six months of 2023, the Company reported unaudited net income of $2.5 million, or $0.43 per diluted share, as compared |

LSBK Price Returns

| 1-mo | 5.54% |

| 3-mo | 11.08% |

| 6-mo | 8.71% |

| 1-year | 16.29% |

| 3-year | N/A |

| 5-year | -0.58% |

| YTD | 9.08% |

| 2023 | -2.98% |

| 2022 | -15.01% |

| 2021 | 18.76% |

| 2020 | N/A |

| 2019 | N/A |

LSBK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LSBK

Here are a few links from around the web to help you further your research on Lake Shore Bancorp Inc's stock as an investment opportunity:Lake Shore Bancorp Inc (LSBK) Stock Price | Nasdaq

Lake Shore Bancorp Inc (LSBK) Stock Quote, History and News - Yahoo Finance

Lake Shore Bancorp Inc (LSBK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...