Mastercard Incorporated (MA): Price and Financial Metrics

MA Price/Volume Stats

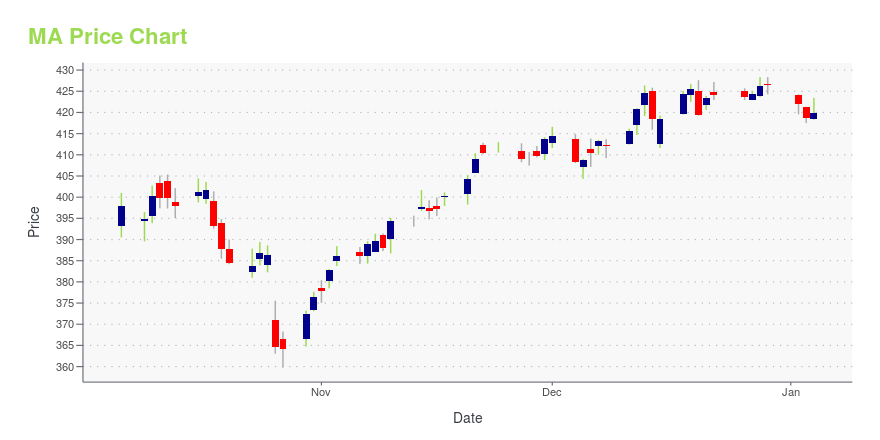

| Current price | $438.18 | 52-week high | $490.00 |

| Prev. close | $429.60 | 52-week low | $359.77 |

| Day low | $432.11 | Volume | 2,039,592 |

| Day high | $440.78 | Avg. volume | 2,491,311 |

| 50-day MA | $447.04 | Dividend yield | 0.6% |

| 200-day MA | $439.64 | Market Cap | 407.34B |

MA Stock Price Chart Interactive Chart >

Mastercard Incorporated (MA) Company Bio

Mastercard provides transaction processing, including authorization, clearing, and settlement, as well as delivers related products and services. The company was founded in 1966 and is based in Purchase, New York.

Latest MA News From Around the Web

Below are the latest news stories about MASTERCARD INC that investors may wish to consider to help them evaluate MA as an investment opportunity.

The Top 7 Stocks to Buy Before They Take Off Next YearThese seven blue-chip stocks to buy can form a robust core portfolio for the next leg higher in 2024 and beyond. |

Why Are They Pounding the Table for PayPal Stock Heading Into 2024?If PayPal is valued like its competitors in payments, it’s a buy. |

The 500 Top Stocks to Buy for 2024, Ranked by AIThese are the very best stocks to buy for 2024 for any investor, according to Tom Yeung's MarketMasterAI system. |

The 5 Durable Economic MoatsAn "economic moat" (also called a "durable competitive advantage"), is a structural advantage in your business that prevents competitors from easily stealing away your customers. |

3 Warren Buffett Stocks to Hold ForeverThe Oracle of Omaha and Berkshire Hathaway's other stock pickers have already done the homework for you. |

MA Price Returns

| 1-mo | -3.00% |

| 3-mo | -5.10% |

| 6-mo | 0.21% |

| 1-year | 11.73% |

| 3-year | 14.27% |

| 5-year | 59.73% |

| YTD | 3.19% |

| 2023 | 23.40% |

| 2022 | -2.66% |

| 2021 | 1.16% |

| 2020 | 20.19% |

| 2019 | 59.16% |

MA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MA

Want to see what other sources are saying about Mastercard Inc's financials and stock price? Try the links below:Mastercard Inc (MA) Stock Price | Nasdaq

Mastercard Inc (MA) Stock Quote, History and News - Yahoo Finance

Mastercard Inc (MA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...