Macerich Co. (MAC): Price and Financial Metrics

MAC Price/Volume Stats

| Current price | $16.23 | 52-week high | $17.69 |

| Prev. close | $15.64 | 52-week low | $9.21 |

| Day low | $15.83 | Volume | 1,321,622 |

| Day high | $16.37 | Avg. volume | 1,916,630 |

| 50-day MA | $15.23 | Dividend yield | 4.08% |

| 200-day MA | $14.70 | Market Cap | 3.50B |

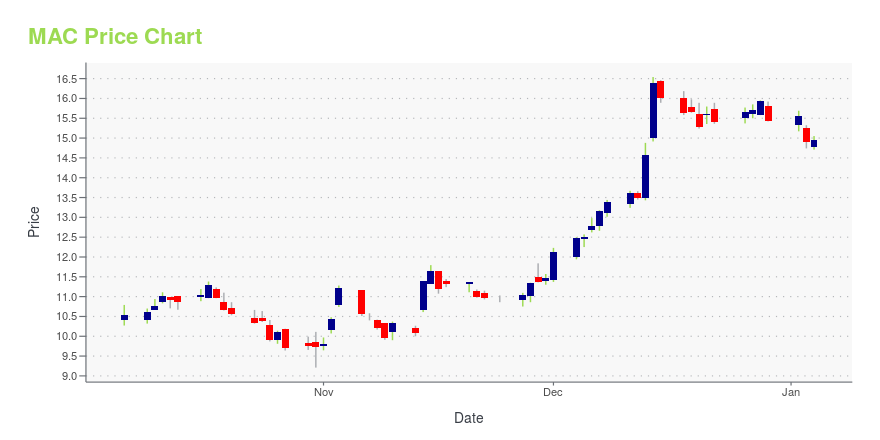

MAC Stock Price Chart Interactive Chart >

Macerich Co. (MAC) Company Bio

The Macerich Company engages in the acquisition, ownership, development, redevelopment, management and leasing of regional and community shopping centers located throughout the United States. The company was founded in 1964 and is based in Santa Monica, California.

Latest MAC News From Around the Web

Below are the latest news stories about MACERICH CO that investors may wish to consider to help them evaluate MAC as an investment opportunity.

The Zacks Analyst Blog Highlights Prologis, Alexandria Real Estate Equities, The Macerich and Innovative Industrial PropertiesPrologis, Alexandria Real Estate Equities, The Macerich and Innovative Industrial Properties are part of the Zacks top Analyst Blog. |

Macerich (MAC) Soars 8.0%: Is Further Upside Left in the Stock?Macerich (MAC) witnessed a jump in share price last session on above-average trading volume. The latest trend in FFO estimate revisions for the stock doesn't suggest further strength down the road. |

Macerich's (MAC) JV Refinances Tysons Corner, Ups FlexibilityMacerich's (MAC) joint venture, which owns Tysons Corner Center, carries out the refinancing of the property for $710 million. The move boosts its financial flexibility and poises it well for growth. |

Macerich Completes $710 Million Refinancing of Tysons Corner CenterTysons Corner Center Exterior Tysons Corner Center in Virginia Tysons Corner Center, A Macerich Property Tysons Corner Center, A Macerich Property SANTA MONICA, Calif., Dec. 05, 2023 (GLOBE NEWSWIRE) -- Macerich (NYSE: MAC), one of the nation’s leading owners, operators and developers of major retail and mixed-use properties in top markets, today announced that Macerich’s joint venture that owns Tysons Corner Center has just closed a $710 million refinance on this high-quality property in Northe |

Macerich (MAC) Up 15.8% Since Last Earnings Report: Can It Continue?Macerich (MAC) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

MAC Price Returns

| 1-mo | 9.66% |

| 3-mo | 4.68% |

| 6-mo | -0.65% |

| 1-year | 38.80% |

| 3-year | 13.59% |

| 5-year | -28.36% |

| YTD | 7.40% |

| 2023 | 45.69% |

| 2022 | -31.57% |

| 2021 | 68.49% |

| 2020 | -54.09% |

| 2019 | -32.18% |

MAC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MAC

Want to see what other sources are saying about Macerich Co's financials and stock price? Try the links below:Macerich Co (MAC) Stock Price | Nasdaq

Macerich Co (MAC) Stock Quote, History and News - Yahoo Finance

Macerich Co (MAC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...