Masco Corp. (MAS): Price and Financial Metrics

MAS Price/Volume Stats

| Current price | $77.45 | 52-week high | $78.94 |

| Prev. close | $75.84 | 52-week low | $47.66 |

| Day low | $75.84 | Volume | 3,007,900 |

| Day high | $77.78 | Avg. volume | 1,977,591 |

| 50-day MA | $68.97 | Dividend yield | 1.63% |

| 200-day MA | $67.55 | Market Cap | 17.06B |

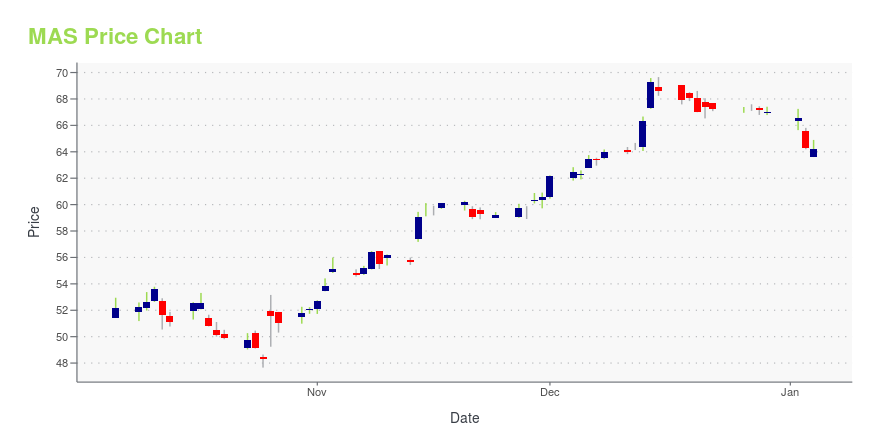

MAS Stock Price Chart Interactive Chart >

Masco Corp. (MAS) Company Bio

Masco Corporation is an American manufacturer of products for the home improvement and new home construction markets. Comprising more than 20 companies, the Masco conglomerate operates nearly 60 manufacturing facilities in the United States and over 20 in other parts of the world. Since 1969 it trades on the NYSE. Under the leadership of Richard Manoogian, the company grew exponentially and subsequently joined the Fortune 500 list of largest U.S. corporations. (Source:Wikipedia)

Latest MAS News From Around the Web

Below are the latest news stories about MASCO CORP that investors may wish to consider to help them evaluate MAS as an investment opportunity.

Masco (MAS) to Gain From Operational Efficiency and ExpansionMasco (MAS) is poised to benefit from the Fed's steady interest rates, coupled with its strong pricing actions and strategic expansion initiatives, securing a path for sustained growth. |

Masco's (MAS) Kichler Lighting Revamps Its Product PortfolioKichler Lighting, a subsidiary of Masco (MAS), launches upgraded and modernized products under its Decorative Exterior Lighting collection. |

Calculating The Fair Value Of Masco Corporation (NYSE:MAS)Key Insights Using the 2 Stage Free Cash Flow to Equity, Masco fair value estimate is US$64.48 Current share price of... |

Insider Sell: Group President Jai Shah Sells 25,000 Shares of Masco Corp (MAS)Recent filings with the SEC have revealed that Jai Shah, Group President of Masco Corporation (NYSE:MAS), has sold 25,000 shares of the company on December 4, 2023. |

Masco (MAS) Just Flashed Golden Cross Signal: Do You Buy?Should investors be excited or worried when a stock's 50 -day simple moving average crosses above the 200-day simple moving average? |

MAS Price Returns

| 1-mo | 16.64% |

| 3-mo | 11.35% |

| 6-mo | 14.17% |

| 1-year | 28.75% |

| 3-year | 37.60% |

| 5-year | 105.51% |

| YTD | 16.57% |

| 2023 | 46.56% |

| 2022 | -32.09% |

| 2021 | 29.61% |

| 2020 | 15.76% |

| 2019 | 66.27% |

MAS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MAS

Want to see what other sources are saying about Masco Corp's financials and stock price? Try the links below:Masco Corp (MAS) Stock Price | Nasdaq

Masco Corp (MAS) Stock Quote, History and News - Yahoo Finance

Masco Corp (MAS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...