MasterCraft Boat Holdings, Inc. (MCFT): Price and Financial Metrics

MCFT Price/Volume Stats

| Current price | $21.09 | 52-week high | $31.70 |

| Prev. close | $20.69 | 52-week low | $17.31 |

| Day low | $20.75 | Volume | 148,794 |

| Day high | $21.20 | Avg. volume | 159,457 |

| 50-day MA | $19.88 | Dividend yield | N/A |

| 200-day MA | $21.04 | Market Cap | 358.13M |

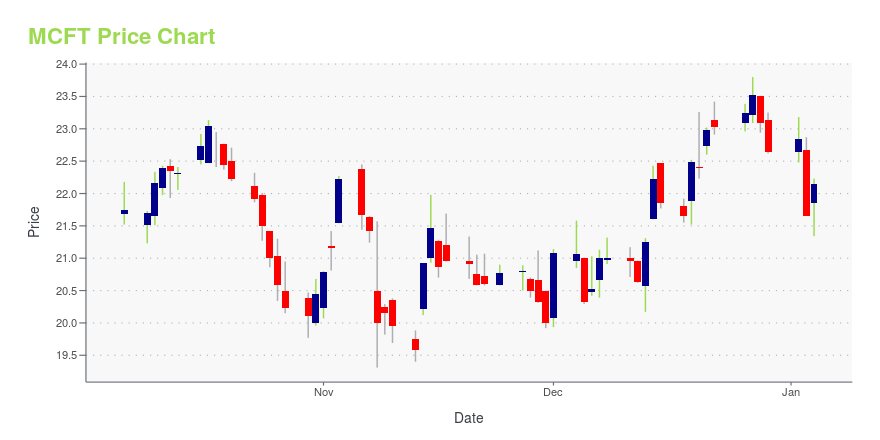

MCFT Stock Price Chart Interactive Chart >

MasterCraft Boat Holdings, Inc. (MCFT) Company Bio

MCBC Holdings Inc. is a designer, manufacturer, and marketer of MasterCraft brand premium performance sport boats. The company was founded in 1968 and is based in Vonore, Tennessee.

Latest MCFT News From Around the Web

Below are the latest news stories about MASTERCRAFT BOAT HOLDINGS INC that investors may wish to consider to help them evaluate MCFT as an investment opportunity.

MasterCraft Boat Holdings, Inc. Reports Results for Fiscal 2024 First QuarterVONORE, Tenn., Nov. 08, 2023 (GLOBE NEWSWIRE) -- MasterCraft Boat Holdings, Inc. (NASDAQ: MCFT) today announced financial results for its fiscal 2024 first quarter ended October 1, 2023. Highlights: Unless otherwise indicated, the highlights and commentary provided herein relate to our continuing operations, which excludes our former NauticStar segment. Results for NauticStar are reported as discontinued operations. Net sales for the first quarter decreased to $104.2 million, down 38.5% from the |

MasterCraft Boat Holdings, Inc. to Webcast Fiscal First Quarter 2024 Earnings Conference Call Wednesday, November 8, 2023Live webcast at 8:30 a.m. EDTVONORE, Tenn., Oct. 25, 2023 (GLOBE NEWSWIRE) -- MasterCraft Boat Holdings, Inc. (NASDAQ: MCFT) (the “Company”) will host a live webcast of its fiscal first quarter 2024 earnings conference call on Wednesday, November 8, 2023, at 8:30 a.m. EDT. Fred Brightbill, Chief Executive Officer and Chairman, Tim Oxley, Chief Financial Officer, and Bobby Potter, Vice President of Strategy and Investor Relations, will discuss the Company’s financial results. The Company will iss |

Estimating The Fair Value Of MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT)Key Insights Using the 2 Stage Free Cash Flow to Equity, MasterCraft Boat Holdings fair value estimate is US$22.68... |

MasterCraft Boat Holdings (NASDAQ:MCFT) Might Become A Compounding MachineTo find a multi-bagger stock, what are the underlying trends we should look for in a business? Typically, we'll want to... |

MasterCraft Boat Holdings, Inc. Issues 2023 Sustainability ReportVONORE, Tenn., Sept. 13, 2023 (GLOBE NEWSWIRE) -- MasterCraft Boat Holdings, Inc. (NASDAQ: MCFT) (the “Company”) today announced that it has issued its 2023 Sustainability Report. The Company recognizes the importance of social and environmental responsibility and global sustainability, and is committed to making the best products in the best way possible. The Company is devoted to reducing its environmental impact, ensuring a healthy and safe workplace for its employees, and acting as a good co |

MCFT Price Returns

| 1-mo | 11.35% |

| 3-mo | 2.63% |

| 6-mo | 2.23% |

| 1-year | -30.10% |

| 3-year | -19.01% |

| 5-year | 27.05% |

| YTD | -6.85% |

| 2023 | -12.49% |

| 2022 | -8.68% |

| 2021 | 14.05% |

| 2020 | 57.71% |

| 2019 | -15.78% |

Continue Researching MCFT

Here are a few links from around the web to help you further your research on MasterCraft Boat Holdings Inc's stock as an investment opportunity:MasterCraft Boat Holdings Inc (MCFT) Stock Price | Nasdaq

MasterCraft Boat Holdings Inc (MCFT) Stock Quote, History and News - Yahoo Finance

MasterCraft Boat Holdings Inc (MCFT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...