M.D.C. Holdings, Inc. (MDC): Price and Financial Metrics

MDC Price/Volume Stats

| Current price | $62.98 | 52-week high | $63.00 |

| Prev. close | $62.95 | 52-week low | $36.47 |

| Day low | $62.97 | Volume | 6,414,200 |

| Day high | $62.99 | Avg. volume | 1,973,656 |

| 50-day MA | $62.69 | Dividend yield | 3.49% |

| 200-day MA | $51.42 | Market Cap | 4.73B |

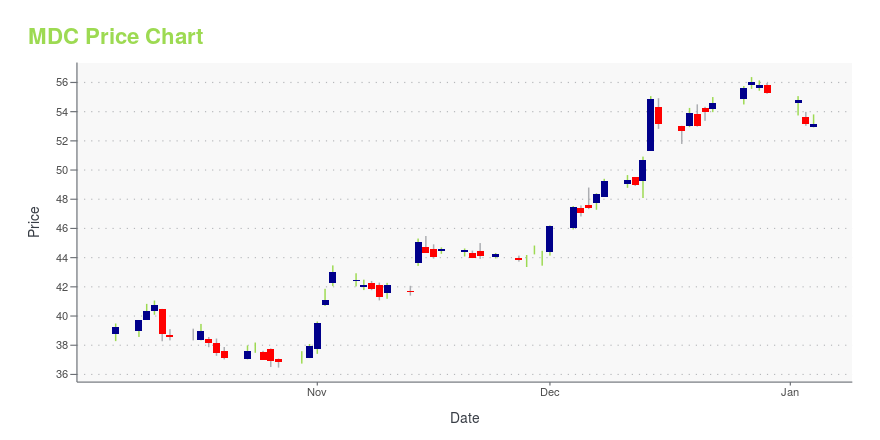

MDC Stock Price Chart Interactive Chart >

M.D.C. Holdings, Inc. (MDC) Company Bio

M.D.C. Holdings, Inc. engages in homebuilding and originating mortgage loans. The company was founded in 1972 and is based in Denver, Colorado.

Latest MDC News From Around the Web

Below are the latest news stories about MDC HOLDINGS INC that investors may wish to consider to help them evaluate MDC as an investment opportunity.

Why M.D.C. Holdings, Inc. (MDC) Outpaced the Stock Market TodayM.D.C. Holdings, Inc. (MDC) reachead $56.01 at the closing of the latest trading day, reflecting a +0.74% change compared to its last close. |

M.D.C. Holdings, Inc. (MDC) Dips More Than Broader Market: What You Should KnowIn the most recent trading session, M.D.C. Holdings, Inc. (MDC) closed at $52.99, indicating a -1.67% shift from the previous trading day. |

Homebuilding analysts don't expect a repeat of 2023's boomHomebuilders will have an interesting 2024 as interest rates are likely to drop, sending more buyers to the market. |

M.D.C. Holdings, Inc. (MDC) Stock Sinks As Market Gains: What You Should KnowThe latest trading day saw M.D.C. Holdings, Inc. (MDC) settling at $48.98, representing a -0.71% change from its previous close. |

Has M.D.C. Holdings, Inc.'s (NYSE:MDC) Impressive Stock Performance Got Anything to Do With Its Fundamentals?Most readers would already be aware that M.D.C. Holdings' (NYSE:MDC) stock increased significantly by 17% over the past... |

MDC Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | 1.43% |

| 1-year | 33.73% |

| 3-year | 41.55% |

| 5-year | 121.82% |

| YTD | 15.00% |

| 2023 | 83.57% |

| 2022 | -40.15% |

| 2021 | 28.27% |

| 2020 | 31.91% |

| 2019 | 40.58% |

MDC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MDC

Want to see what other sources are saying about Mdc Holdings Inc's financials and stock price? Try the links below:Mdc Holdings Inc (MDC) Stock Price | Nasdaq

Mdc Holdings Inc (MDC) Stock Quote, History and News - Yahoo Finance

Mdc Holdings Inc (MDC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...