MGE Energy Inc. (MGEE): Price and Financial Metrics

MGEE Price/Volume Stats

| Current price | $86.46 | 52-week high | $87.48 |

| Prev. close | $86.01 | 52-week low | $61.94 |

| Day low | $86.28 | Volume | 137,400 |

| Day high | $87.48 | Avg. volume | 275,600 |

| 50-day MA | $78.75 | Dividend yield | 2.05% |

| 200-day MA | $74.30 | Market Cap | 3.13B |

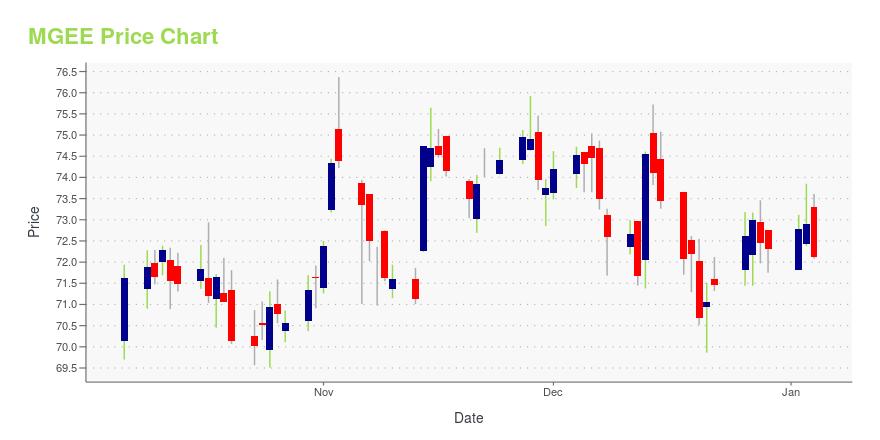

MGEE Stock Price Chart Interactive Chart >

MGE Energy Inc. (MGEE) Company Bio

MGE Energy operates as a public utility holding company in Wisconsin. It operates through five segments: Regulated Electric Utility Operations; Regulated Gas Utility Operations; Nonregulated Energy Operations; Transmission Investments; and All Other. The company was founded in 1855 and is based in Madison, Wisconsin.

Latest MGEE News From Around the Web

Below are the latest news stories about MGE ENERGY INC that investors may wish to consider to help them evaluate MGEE as an investment opportunity.

MGE Energy, Inc.'s (NASDAQ:MGEE) one-year returns climbed after last week's 4.3% gain, institutional investors must be happyKey Insights Institutions' substantial holdings in MGE Energy implies that they have significant influence over the... |

MGE Energy Inc (MGEE) Reports Q3 2023 Earnings of $37.9 Million, Up from $33. ...Increased investments and warmer weather drive up residential sales by 5% |

MGE Energy Reports Third-Quarter 2023 EarningsMADISON, Wis., November 02, 2023--MGE Energy Reports Third-Quarter 2023 Earnings |

Here's What To Make Of MGE Energy's (NASDAQ:MGEE) Decelerating Rates Of ReturnTo find a multi-bagger stock, what are the underlying trends we should look for in a business? Firstly, we'd want to... |

MGE Energy's (NASDAQ:MGEE) 5.3% CAGR outpaced the company's earnings growth over the same five-year periodIf you buy and hold a stock for many years, you'd hope to be making a profit. Furthermore, you'd generally like to see... |

MGEE Price Returns

| 1-mo | 14.96% |

| 3-mo | 12.03% |

| 6-mo | 32.71% |

| 1-year | 10.81% |

| 3-year | 18.19% |

| 5-year | 28.79% |

| YTD | 21.04% |

| 2023 | 5.10% |

| 2022 | -12.58% |

| 2021 | 19.90% |

| 2020 | -9.30% |

| 2019 | 34.04% |

MGEE Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MGEE

Want to see what other sources are saying about Mge Energy Inc's financials and stock price? Try the links below:Mge Energy Inc (MGEE) Stock Price | Nasdaq

Mge Energy Inc (MGEE) Stock Quote, History and News - Yahoo Finance

Mge Energy Inc (MGEE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...