Merit Medical Systems, Inc. (MMSI): Price and Financial Metrics

MMSI Price/Volume Stats

| Current price | $85.52 | 52-week high | $88.85 |

| Prev. close | $85.00 | 52-week low | $62.58 |

| Day low | $84.68 | Volume | 293,389 |

| Day high | $85.94 | Avg. volume | 444,076 |

| 50-day MA | $83.76 | Dividend yield | N/A |

| 200-day MA | $76.46 | Market Cap | 4.97B |

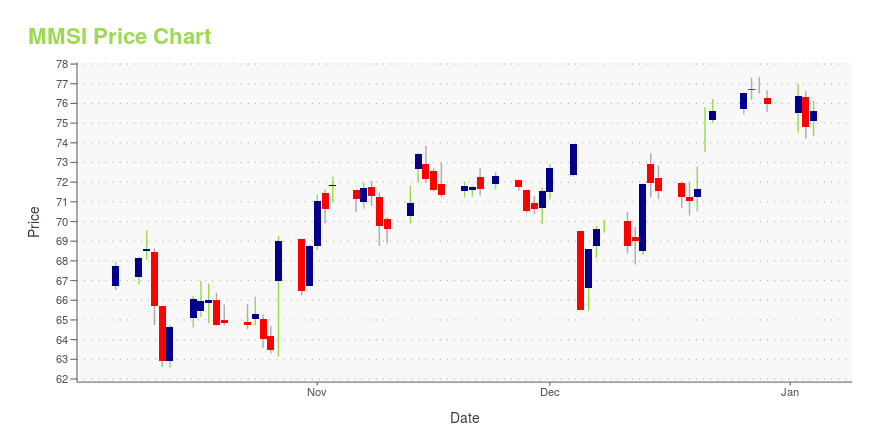

MMSI Stock Price Chart Interactive Chart >

Merit Medical Systems, Inc. (MMSI) Company Bio

Merit Medical Systems is engaged in the development, manufacture and distribution of proprietary disposable medical devices used in interventional and diagnostic procedures, particularly in cardiology, radiology and endoscopy. The company was founded in 1987 and is based in South Jordan, Utah.

Latest MMSI News From Around the Web

Below are the latest news stories about MERIT MEDICAL SYSTEMS INC that investors may wish to consider to help them evaluate MMSI as an investment opportunity.

MMSI or WST: Which Is the Better Value Stock Right Now?MMSI vs. WST: Which Stock Is the Better Value Option? |

Calculating The Intrinsic Value Of Merit Medical Systems, Inc. (NASDAQ:MMSI)Key Insights Using the 2 Stage Free Cash Flow to Equity, Merit Medical Systems fair value estimate is US$66.09 Current... |

Here’s Why Merit Medical Systems (MMSI) Fell in Q3Chartwell Investment Partners, LLC, an affiliate of Carillon Tower Advisers, Inc., released the “Carillon Chartwell Small Cap Value Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. Information technology and industrials were the top-performing sectors in the Carillon Chartwell Small Cap Growth Fund, with alpha production coming from well-chosen stocks. […] |

Merit Medical Announces Process for Chief Executive Officer Succession PlanningSOUTH JORDAN, Utah, Dec. 18, 2023 (GLOBE NEWSWIRE) -- Merit Medical Systems, Inc. (NASDAQ: MMSI), a leading global manufacturer and marketer of healthcare technology, today outlined the ongoing succession planning process for its Chief Executive Officer (CEO). Pursuant to an Amended and Restated Employment Agreement, effective June 8, 2023, Merit founder, CEO, and President, Fred Lampropoulos, will continue to serve as Merit’s CEO and President through December 31, 2025. To carry out its respons |

Why Merit Medical (MMSI) is a Top Momentum Stock for the Long-TermWhether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service. |

MMSI Price Returns

| 1-mo | 3.09% |

| 3-mo | 15.91% |

| 6-mo | 9.47% |

| 1-year | 18.15% |

| 3-year | 32.53% |

| 5-year | 108.59% |

| YTD | 12.59% |

| 2023 | 7.56% |

| 2022 | 13.35% |

| 2021 | 12.23% |

| 2020 | 77.80% |

| 2019 | -44.06% |

Continue Researching MMSI

Want to do more research on Merit Medical Systems Inc's stock and its price? Try the links below:Merit Medical Systems Inc (MMSI) Stock Price | Nasdaq

Merit Medical Systems Inc (MMSI) Stock Quote, History and News - Yahoo Finance

Merit Medical Systems Inc (MMSI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...