MediciNova, Inc. (MNOV): Price and Financial Metrics

MNOV Price/Volume Stats

| Current price | $1.31 | 52-week high | $2.66 |

| Prev. close | $1.32 | 52-week low | $1.26 |

| Day low | $1.30 | Volume | 5,549 |

| Day high | $1.36 | Avg. volume | 51,466 |

| 50-day MA | $1.40 | Dividend yield | N/A |

| 200-day MA | $1.79 | Market Cap | 64.25M |

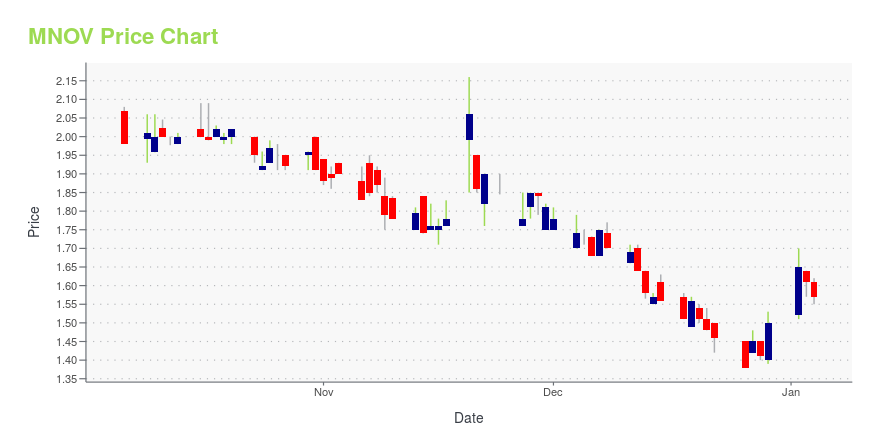

MNOV Stock Price Chart Interactive Chart >

MediciNova, Inc. (MNOV) Company Bio

MediciNova, Inc., a biopharmaceutical company, focuses on acquiring and developing novel and small molecule therapeutics for the treatment of serious diseases with unmet medical needs for the United States market. The company was founded in 2000 and is based in La Jolla, California.

Latest MNOV News From Around the Web

Below are the latest news stories about MEDICINOVA INC that investors may wish to consider to help them evaluate MNOV as an investment opportunity.

MediciNova Announces Abstract Regarding MN-166 (ibudilast) in Chlorine Gas-induced Lung Injury Accepted for Presentation at the 63rd Annual Meeting of the Society of ToxicologyLA JOLLA, Calif., Dec. 21, 2023 (GLOBE NEWSWIRE) -- MediciNova, Inc., a biopharmaceutical company traded on the NASDAQ Global Market (NASDAQ:MNOV) and the Standard Market of the Tokyo Stock Exchange (Code Number: 4875), today announced that an abstract regarding results of a nonclinical study of MN-166 (ibudilast) in chlorine gas-induced acute lung injury has been selected for a poster presentation at the Society of Toxicology (SOT) 63rd Annual Meeting and ToxExpo to be held March 10 - 14, 2024 |

MediciNova Receives a Notice of Decision to Grant for a New Patent Covering MN-166 (ibudilast) for the Treatment of Progressive MS in EuropeLA JOLLA, Calif., Dec. 06, 2023 (GLOBE NEWSWIRE) -- MediciNova, Inc., a biopharmaceutical company traded on the NASDAQ Global Market (NASDAQ:MNOV) and the Standard Market of the Tokyo Stock Exchange (Code Number: 4875), today announced it has received a Notice of Decision to Grant from the European Patent Office for a pending patent application which covers the combination of MN-166 (ibudilast) and interferon-beta for the treatment of progressive multiple sclerosis (progressive MS). Once issued, |

MNOV: Encouraging Phase 2 Glioblastoma Results Presented at SNO…By David Bautz, PhD NASDAQ:MNOV READ THE FULL MNOV RESEARCH REPORT Business Update New Data for MN-166 in GBM Presented at SNO On November 19, 2023, MediciNova, Inc. (NASDAQ:MNOV) announced new data and results of a Phase 2 clinical trial of MN-166 (ibudilast) in glioblastoma (GBM) were presented at the 28th Annual Meeting of the Society for Neuro-Oncology (SNO) ( Lauko et al., 2023 ). The Phase |

The past five years for MediciNova (NASDAQ:MNOV) investors has not been profitableLong term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut... |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayIt's time to start the week with a breakdown of the biggest pre-market stock movers traders need to watch on Monday morning! |

MNOV Price Returns

| 1-mo | -10.88% |

| 3-mo | -10.88% |

| 6-mo | -31.77% |

| 1-year | -38.21% |

| 3-year | -72.93% |

| 5-year | -88.04% |

| YTD | -12.67% |

| 2023 | -26.83% |

| 2022 | -23.51% |

| 2021 | -49.05% |

| 2020 | -21.96% |

| 2019 | -17.50% |

Loading social stream, please wait...