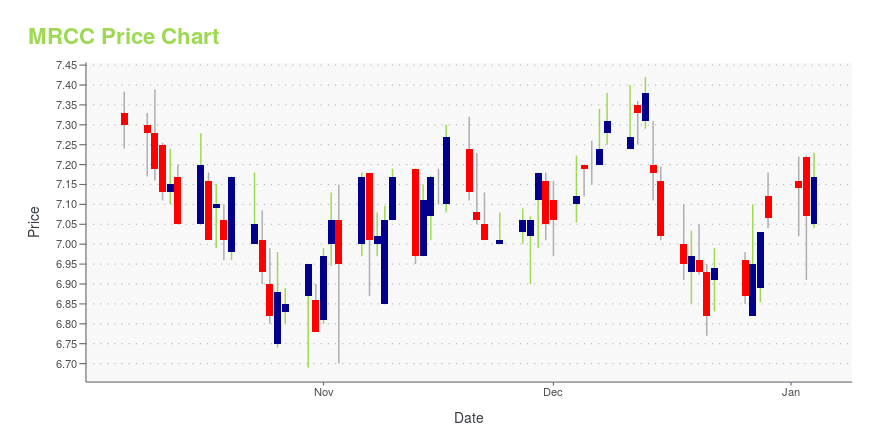

Monroe Capital Corporation (MRCC): Price and Financial Metrics

MRCC Price/Volume Stats

| Current price | $7.22 | 52-week high | $8.85 |

| Prev. close | $7.07 | 52-week low | $6.55 |

| Day low | $7.10 | Volume | 41,000 |

| Day high | $7.27 | Avg. volume | 65,629 |

| 50-day MA | $7.88 | Dividend yield | 14.24% |

| 200-day MA | $8.02 | Market Cap | 156.43M |

MRCC Stock Price Chart Interactive Chart >

Monroe Capital Corporation (MRCC) Company Bio

Monroe Capital LLC is a private equity firm specializing in bridge loans, exit financing, capital restructuring, buyouts, leveraged recapitalizations, turnaround, growth capital, acquisition, expansion, refinancings, balance sheet restructurings, portfolio acquisitions, unitranche financings, senior and junior debt, mezzanine debt, second lien or last-out loans, senior loans, equity co-investments for both ESOP and non-ESOP transactions and acquisitions of distressed debt. The company was founded in 2004 and is based in Chicago, Illinois.

MRCC Price Returns

| 1-mo | -5.37% |

| 3-mo | -11.93% |

| 6-mo | -3.69% |

| 1-year | 12.37% |

| 3-year | -1.02% |

| 5-year | 54.61% |

| YTD | -12.34% |

| 2024 | 36.74% |

| 2023 | -5.68% |

| 2022 | -15.37% |

| 2021 | 53.22% |

| 2020 | -15.17% |

MRCC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MRCC

Want to do more research on MONROE CAPITAL Corp's stock and its price? Try the links below:MONROE CAPITAL Corp (MRCC) Stock Price | Nasdaq

MONROE CAPITAL Corp (MRCC) Stock Quote, History and News - Yahoo Finance

MONROE CAPITAL Corp (MRCC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...