Marathon Oil Corporation (MRO): Price and Financial Metrics

MRO Price/Volume Stats

| Current price | $28.55 | 52-week high | $30.06 |

| Prev. close | $28.92 | 52-week low | $21.81 |

| Day low | $28.43 | Volume | 37,029,700 |

| Day high | $29.37 | Avg. volume | 8,062,779 |

| 50-day MA | $27.57 | Dividend yield | 1.54% |

| 200-day MA | $27.22 | Market Cap | 15.97B |

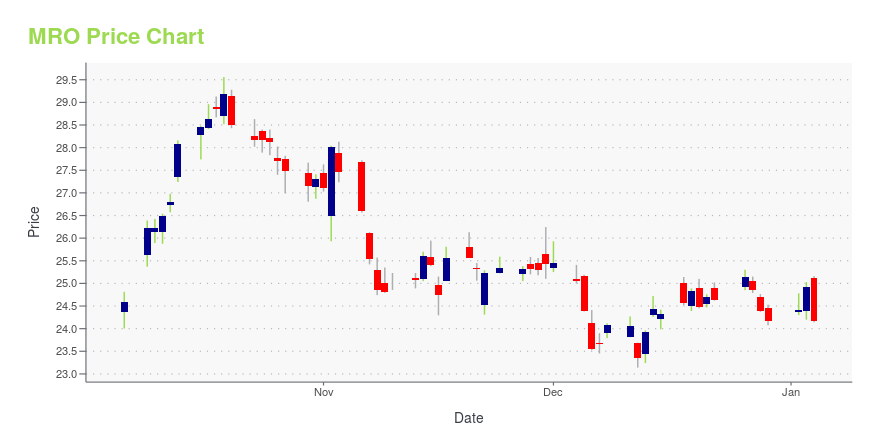

MRO Stock Price Chart Interactive Chart >

Marathon Oil Corporation (MRO) Company Bio

Marathon Oil Corp is an exploration and production company. It focuses on producing crude oil and condensate, natural gas liquids and natural gas as well as bitumen from oil sands deposits. In 2011, Marathon Oil spun off from Marathon Petroleum Corporation becoming an independent exploration and production company. The company has operations in four of the oil rich basins in the United States – the Eagle Ford Basin, the Bakken Basin, the STACK/SCOOP basin, and the Permian Basin. Marathon Oil employs just under 1,700 individuals and is headquartered in Houston, Texas. Lee Tillman serves as President and Chief Executive Officer.

MRO Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | 7.94% |

| 1-year | 3.82% |

| 3-year | 14.20% |

| 5-year | 530.24% |

| YTD | N/A |

| 2024 | 0.00% |

| 2023 | -10.75% |

| 2022 | 64.86% |

| 2021 | 146.18% |

| 2020 | -50.88% |

MRO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MRO

Want to do more research on Marathon Oil Corp's stock and its price? Try the links below:Marathon Oil Corp (MRO) Stock Price | Nasdaq

Marathon Oil Corp (MRO) Stock Quote, History and News - Yahoo Finance

Marathon Oil Corp (MRO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...