Marvell Technology Inc. (MRVL): Price and Financial Metrics

MRVL Price/Volume Stats

| Current price | $74.65 | 52-week high | $127.48 |

| Prev. close | $72.01 | 52-week low | $47.08 |

| Day low | $71.15 | Volume | 16,914,801 |

| Day high | $75.25 | Avg. volume | 18,903,963 |

| 50-day MA | $68.39 | Dividend yield | 0.33% |

| 200-day MA | $0.00 | Market Cap | 64.48B |

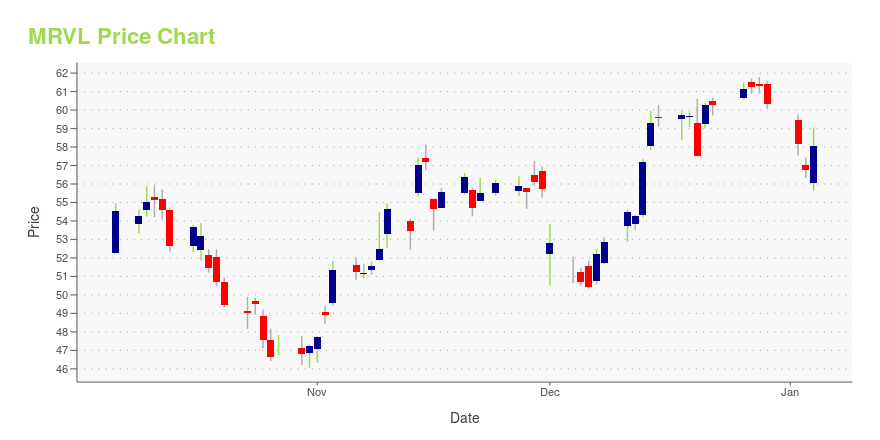

MRVL Stock Price Chart Interactive Chart >

Marvell Technology Inc. (MRVL) Company Bio

Marvell Technology, Inc. is an American company, headquartered in Santa Clara, California, which develops and produces semiconductors and related technology. Founded in 1995, the company had more than 6,000 employees as of 2021, with over 10,000 patents worldwide, and an annual revenue of $4.5 billion for 2021. (Source:Wikipedia)

MRVL Price Returns

| 1-mo | 1.63% |

| 3-mo | 47.59% |

| 6-mo | -40.26% |

| 1-year | 12.61% |

| 3-year | 45.31% |

| 5-year | 111.78% |

| YTD | -32.25% |

| 2024 | 83.79% |

| 2023 | 63.68% |

| 2022 | -57.48% |

| 2021 | 84.62% |

| 2020 | 80.25% |

MRVL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MRVL

Want to do more research on Marvell Technology Group Ltd's stock and its price? Try the links below:Marvell Technology Group Ltd (MRVL) Stock Price | Nasdaq

Marvell Technology Group Ltd (MRVL) Stock Quote, History and News - Yahoo Finance

Marvell Technology Group Ltd (MRVL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...