Mannatech, Incorporated (MTEX): Price and Financial Metrics

MTEX Price/Volume Stats

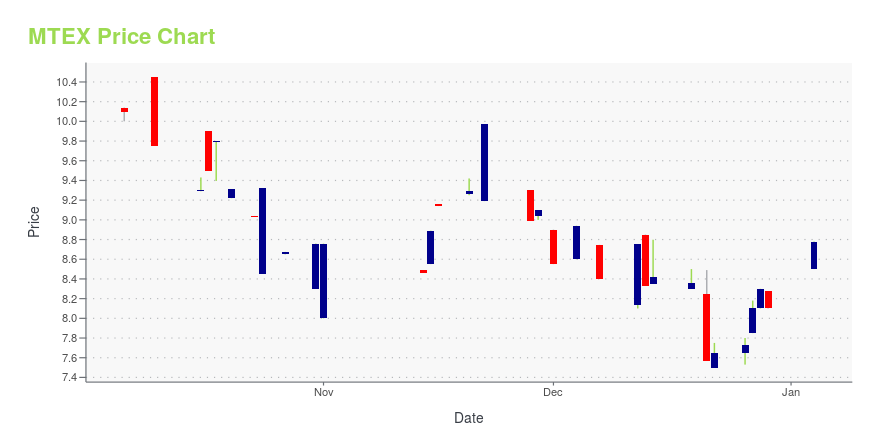

| Current price | $7.39 | 52-week high | $15.10 |

| Prev. close | $7.30 | 52-week low | $6.75 |

| Day low | $7.22 | Volume | 1,700 |

| Day high | $7.45 | Avg. volume | 1,341 |

| 50-day MA | $7.56 | Dividend yield | N/A |

| 200-day MA | $9.54 | Market Cap | 13.93M |

MTEX Stock Price Chart Interactive Chart >

Mannatech, Incorporated (MTEX) Company Bio

Mannatech, Incorporated provides wellness solutions. It develops, markets, and sells nutritional supplements; topical and skin care, and anti-aging products; and weight-management products. The company primarily sells its products directly, as well as through network marketing channels and a Website. It operates in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. Mannatech, Incorporated was founded in 1993 and is headquartered in Flower Mound, Texas.

Latest MTEX News From Around the Web

Below are the latest news stories about MANNATECH INC that investors may wish to consider to help them evaluate MTEX as an investment opportunity.

Mannatech Inc (MTEX) Reports Decrease in Third Quarter Net Sales and Net Income for 2023Operating income also sees a decline while recruitment of new associates and preferred customers increases |

Mannatech Reports Third Quarter End 2023 Financial ResultsFLOWER MOUND, Texas, November 07, 2023--Mannatech, Incorporated (NASDAQ: MTEX), a global health and wellness company committed to transforming lives to make a better world, today announced financial results for its third quarter of 2023. |

Mannatech Reports Second Quarter End 2023 Financial ResultsFLOWER MOUND, Texas, August 14, 2023--Mannatech, Incorporated (NASDAQ: MTEX), a global health and wellness company committed to transforming lives to make a better world, today announced financial results for its second quarter of 2023. |

A Look At The Fair Value Of Mannatech, Incorporated (NASDAQ:MTEX)Key Insights Using the Dividend Discount Model, Mannatech fair value estimate is US$11.67 Current share price of... |

We Wouldn't Be Too Quick To Buy Mannatech, Incorporated (NASDAQ:MTEX) Before It Goes Ex-DividendMannatech, Incorporated ( NASDAQ:MTEX ) stock is about to trade ex-dividend in 4 days. Typically, the ex-dividend date... |

MTEX Price Returns

| 1-mo | 9.48% |

| 3-mo | -9.77% |

| 6-mo | -24.21% |

| 1-year | -36.89% |

| 3-year | -70.07% |

| 5-year | -45.27% |

| YTD | -8.77% |

| 2023 | -53.55% |

| 2022 | -51.65% |

| 2021 | 120.10% |

| 2020 | 26.22% |

| 2019 | -11.79% |

Continue Researching MTEX

Want to see what other sources are saying about Mannatech Inc's financials and stock price? Try the links below:Mannatech Inc (MTEX) Stock Price | Nasdaq

Mannatech Inc (MTEX) Stock Quote, History and News - Yahoo Finance

Mannatech Inc (MTEX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...