Mitsubishi UFJ Financial Group Inc. ADR (MUFG): Price and Financial Metrics

MUFG Price/Volume Stats

| Current price | $11.13 | 52-week high | $11.48 |

| Prev. close | $11.04 | 52-week low | $7.38 |

| Day low | $11.08 | Volume | 1,290,953 |

| Day high | $11.16 | Avg. volume | 2,606,710 |

| 50-day MA | $10.60 | Dividend yield | 1.78% |

| 200-day MA | $9.61 | Market Cap | 130.51B |

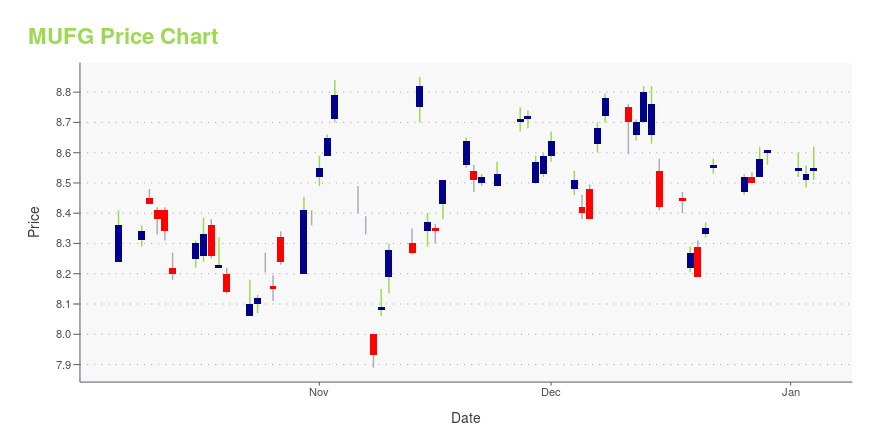

MUFG Stock Price Chart Interactive Chart >

Mitsubishi UFJ Financial Group Inc. ADR (MUFG) Company Bio

Mitsubishi UFJ Financial Group, Inc. (MUFG; 株式会社三菱UFJフィナンシャル・グループ, Kabushiki gaisha Mitsubishi Yūefujei Finansharu Gurūpu) is a Japanese bank holding and financial services company headquartered in Chiyoda, Tokyo, Japan. (Source:Wikipedia)

Latest MUFG News From Around the Web

Below are the latest news stories about MITSUBISHI UFJ FINANCIAL GROUP INC that investors may wish to consider to help them evaluate MUFG as an investment opportunity.

Are You Looking for a High-Growth Dividend Stock?Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Mitsubishi UFJ (MUFG) have what it takes? Let's find out. |

Morgan Stanley (MS) to See Record Japan Income as Trading RevivesMorgan Stanley (MS) expects record revenues from Japan on the back of the country's debt and rates market trading resurgence. |

MUFG Brokerage JV Sued Again Over Credit Suisse AT1 Losses(Bloomberg) -- Another group of Japanese investors sued Mitsubishi UFJ Financial Group Inc.’s joint brokerage venture with Morgan Stanley, the latest litigation over losses on Credit Suisse’s riskiest debt that became worthless. Most Read from BloombergChinese Carmaker Overtakes Tesla as World’s Most Popular EV MakerTesla Plans Revamp of Smash Hit Model Y From China PlantApple’s iPhone Design Chief Enlisted by Jony Ive, Sam Altman to Work on AI DevicesHow Were So Many Economists So Wrong About t |

Morgan Stanley Expects Record Japan Revenue as BOJ Fuels Trading(Bloomberg) -- Morgan Stanley said it expects to record its highest-ever income from Japan as bets on a shift in the nation’s monetary policy fuel a trading revival.Most Read from BloombergS&P 500 Trades Within a Whisker of All-Time High: Markets WrapGoldman’s Painful 2023 Lesson on China Forces Rethink of Emerging MarketsApple to Fight Watch Ban in Court After White House Declines to ActHow Were So Many Economists So Wrong About the Recession?Ethiopia Fails to Pay Coupon, Becoming Latest Africa |

Japan banks scramble to beef up asset management business amid govt reform pushTOKYO (Reuters) -The Japanese government's reform push for the country's $5 trillion asset management industry has sparked a series of action plans from top Japanese banking groups to beef up their long overlooked asset management business. Asset management has emerged as an area of focus for the banks this year as the financial regulator sought their help to shake up the industry in line with Japan's policy pledge to turn dormant household savings into investments. "We aim to build up the asset management business as the group's fourth pillar after banking, trust banking and brokerages," Mitsubishi UFJ Financial Group's chief executive Hironori Kamezawa told Reuters in an interview. |

MUFG Price Returns

| 1-mo | 7.95% |

| 3-mo | 12.31% |

| 6-mo | 20.85% |

| 1-year | 44.74% |

| 3-year | 118.13% |

| 5-year | 151.32% |

| YTD | 29.27% |

| 2023 | 30.77% |

| 2022 | 24.64% |

| 2021 | 25.26% |

| 2020 | -16.51% |

| 2019 | 13.59% |

MUFG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MUFG

Want to do more research on Mitsubishi Ufj Financial Group Inc's stock and its price? Try the links below:Mitsubishi Ufj Financial Group Inc (MUFG) Stock Price | Nasdaq

Mitsubishi Ufj Financial Group Inc (MUFG) Stock Quote, History and News - Yahoo Finance

Mitsubishi Ufj Financial Group Inc (MUFG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...