National Instruments Corporation (NATI): Price and Financial Metrics

NATI Price/Volume Stats

| Current price | $59.98 | 52-week high | $59.99 |

| Prev. close | $59.98 | 52-week low | $34.97 |

| Day low | $59.98 | Volume | 5,083,600 |

| Day high | $59.99 | Avg. volume | 1,822,658 |

| 50-day MA | $59.48 | Dividend yield | 1.87% |

| 200-day MA | $55.01 | Market Cap | 7.97B |

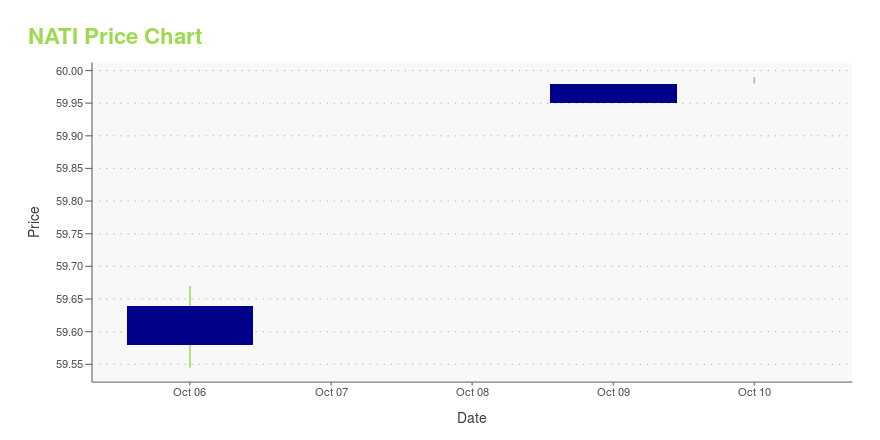

NATI Stock Price Chart Interactive Chart >

National Instruments Corporation (NATI) Company Bio

National Instruments designs, manufactures, and sells systems to engineers and scientists worldwide. The Company offers graphical system design approach to engineering, which provides a software and hardware platform for the development of systems needing measurement and control. The company was founded in 1976 and is based in Austin, Texas.

Latest NATI News From Around the Web

Below are the latest news stories about NATIONAL INSTRUMENTS CORP that investors may wish to consider to help them evaluate NATI as an investment opportunity.

NI Expands Capabilities of the Third Generation Vector Signal TransceiverAUSTIN, Texas, September 12, 2023--NI's VST enables fast and versatile RF measurements for testing next-generation aerospace, defense, and wireless products |

NI Announces its Most Compact and High-Density Battery Cycler & Emulator for EV, Aerospace, and Energy TestAUSTIN, Texas, September 11, 2023--NI Announces Most Compact and High-Density Battery Cycler & Emulator for EV, Aerospace, and Energy Test |

Emerson (EMR) to Buy Afag, Boost Factory Automation PortfolioEmerson's (EMR) impending acquisition of Afag boosts the Discrete Automation sub-segment, expanding capabilities in factory automation. |

The 3 Best Robotics Stocks to Buy in AugustThe new AI wave has a lot of uses outside of the online world, such as these three best robotics stocks to buy. |

National Instruments (NATI) Q2 Earnings and Revenues Lag EstimatesNational Instruments (NATI) delivered earnings and revenue surprises of -15% and 5.59%, respectively, for the quarter ended June 2023. Do the numbers hold clues to what lies ahead for the stock? |

NATI Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 2.14% |

| 3-year | 54.42% |

| 5-year | 48.10% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -12.94% |

| 2021 | 1.98% |

| 2020 | 6.71% |

| 2019 | -4.52% |

NATI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NATI

Want to see what other sources are saying about National Instruments Corp's financials and stock price? Try the links below:National Instruments Corp (NATI) Stock Price | Nasdaq

National Instruments Corp (NATI) Stock Quote, History and News - Yahoo Finance

National Instruments Corp (NATI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...