Newmont Corp. (NEM): Price and Financial Metrics

NEM Price/Volume Stats

| Current price | $46.73 | 52-week high | $48.97 |

| Prev. close | $45.70 | 52-week low | $29.42 |

| Day low | $46.13 | Volume | 8,371,515 |

| Day high | $47.17 | Avg. volume | 11,320,041 |

| 50-day MA | $43.45 | Dividend yield | 2.12% |

| 200-day MA | $38.83 | Market Cap | 53.89B |

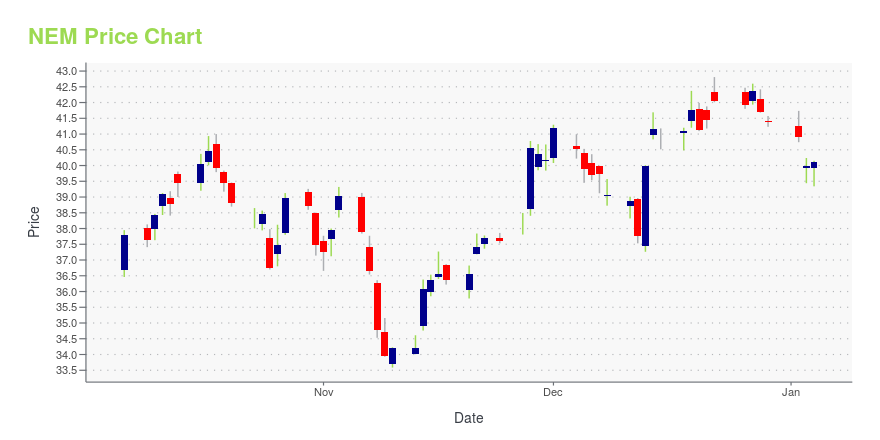

NEM Stock Price Chart Interactive Chart >

Newmont Corp. (NEM) Company Bio

Newmont, based in Greenwood Village, Colorado, United States, is the world's largest gold mining company. Incorporated in 1921, it has ownership of gold mines in Nevada, Colorado, Ontario, Quebec, Mexico, the Dominican Republic, Australia, Ghana, Argentina, Peru, and Suriname. In addition to gold, Newmont mines copper, silver, zinc and lead. (Source:Wikipedia)

Latest NEM News From Around the Web

Below are the latest news stories about NEWMONT CORP that investors may wish to consider to help them evaluate NEM as an investment opportunity.

3 Blue-Chip Stocks Set for a 50% Surge in the Coming YearThese are the attractively valued blue-chip stocks to buy as they represent companies with a positive outlook for 2024. |

S&P 500 Gains and Losses Today: Nike Warns of Soft Sales and Plans Spending CutsThe S&P 500 posted gains of 0.2% on Friday, Dec. 22, 2023, heading into the holiday break amid expectations that the Fed will cut interest rates next year. |

7 Stocks You’ll Regret Not Buying Soon: December EditionThese are the undervalued stocks to buy and represent fundamentally strong companies that will create value. |

Caterpillar (CAT) Demos Battery Electric Underground Mining TruckCaterpillar (CAT) demonstrates its first battery electric underground mining truck, in sync with its target to provide more sustainable choices for the underground mining industry. |

5 Stocks Poised for Growth in Papua New Guinea's Golden Frontier Amid Record High Gold PricesGold has recently achieved an unprecedented milestone, surging to an all-time high of $2,135 per ounce. This extraordinary rise has been fueled by expectations of interest rate cuts, a weaker dolla... |

NEM Price Returns

| 1-mo | 12.74% |

| 3-mo | 10.02% |

| 6-mo | 38.50% |

| 1-year | 14.82% |

| 3-year | -14.67% |

| 5-year | 46.38% |

| YTD | 14.48% |

| 2023 | -8.76% |

| 2022 | -20.77% |

| 2021 | 7.40% |

| 2020 | 40.28% |

| 2019 | 30.52% |

NEM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NEM

Want to do more research on NEWMONT Corp's stock and its price? Try the links below:NEWMONT Corp (NEM) Stock Price | Nasdaq

NEWMONT Corp (NEM) Stock Quote, History and News - Yahoo Finance

NEWMONT Corp (NEM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...