Newtek Business Services Corp. (NEWT): Price and Financial Metrics

NEWT Price/Volume Stats

| Current price | $13.87 | 52-week high | $19.36 |

| Prev. close | $14.39 | 52-week low | $10.07 |

| Day low | $13.75 | Volume | 365,300 |

| Day high | $14.47 | Avg. volume | 156,748 |

| 50-day MA | $13.30 | Dividend yield | 5.12% |

| 200-day MA | $12.76 | Market Cap | 343.06M |

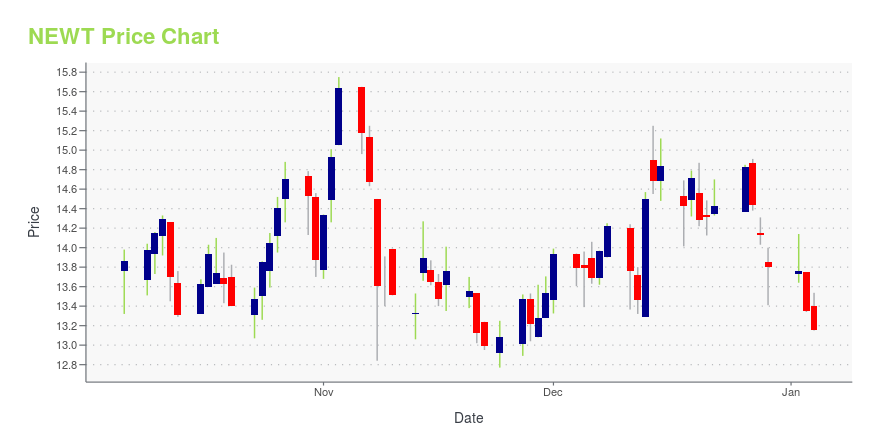

NEWT Stock Price Chart Interactive Chart >

Newtek Business Services Corp. (NEWT) Company Bio

Newtek Business Services provides financial and business services to the small-and medium-sized business market in the United States and internationally. It operates through Electronic Payment Processing, Managed Technology Solutions, Small Business Finance, All Other, and Capcos segments. The company was founded in 1998 and is based in New York, New York.

Latest NEWT News From Around the Web

Below are the latest news stories about NEWTEKONE INC that investors may wish to consider to help them evaluate NEWT as an investment opportunity.

NewtekOne, Inc. Declares a Quarterly Dividend of $0.18 per ShareBOCA RATON, Fla., Dec. 11, 2023 (GLOBE NEWSWIRE) -- NewtekOne, Inc. (the “Company”) (NASDAQ: NEWT), today announced that its Board of Directors declared a quarterly cash dividend of $0.18 per share on the outstanding common stock of NewtekOne. The dividend is payable on January 12, 2024 to shareholders of record as of December 29, 2023. About NewtekOne, Inc. NewtekOne®, Your Business Solutions Company®, is a financial holding company, which along with its bank and non-bank consolidated subsidiar |

3 Underperforming Bank Stocks You Better Not Be Buyingunderstand the risks of underperforming bank stocks in amidst the uncertainty in the market at this time offering little upside |

NewtekOne, Inc. Launches Newtek AccountingBOCA RATON, Fla., Nov. 29, 2023 (GLOBE NEWSWIRE) -- NewtekOne, Inc. (the “Company” or “NewtekOne”) (NASDAQ: NEWT), announced today that it has partnered with 1-800Accountant (https://1800accountant.com/), America’s leading virtual accounting firm for small businesses, for NewtekOne to offer 1-800Accountant’s accounting services to NewtekOne’s independent business owner clients and referral partners via “Newtek Accounting” (newtekaccounting.com). Through Newtek Accounting, NewtekOne's clients wil |

Newtek Bank, N.A. Hires Chief Operating Officer of Digital Banking OperationsBOCA RATON, Fla., Nov. 28, 2023 (GLOBE NEWSWIRE) -- NewtekOne, Inc. (the “Company”) (NASDAQ: NEWT), today announced that its bank subsidiary, Newtek Bank, N.A., has hired Ms. Jennifer Merritt as Chief Operating Officer of digital banking operations, effective November 27, 2023. Ms. Merritt comes to Newtek Bank with over a decade of banking experience with specific focuses on digital banking and banking-product development. Most recently, Jennifer was Senior Vice President, Strategic Operations L |

Analysts Just Shaved Their NewtekOne, Inc. (NASDAQ:NEWT) Forecasts DramaticallyThe analysts covering NewtekOne, Inc. ( NASDAQ:NEWT ) delivered a dose of negativity to shareholders today, by making a... |

NEWT Price Returns

| 1-mo | 13.90% |

| 3-mo | 27.98% |

| 6-mo | 10.49% |

| 1-year | -18.70% |

| 3-year | -47.73% |

| 5-year | 7.86% |

| YTD | 3.76% |

| 2023 | -10.65% |

| 2022 | -33.20% |

| 2021 | 55.76% |

| 2020 | -1.80% |

| 2019 | 42.85% |

NEWT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...