National HealthCare Corporation (NHC): Price and Financial Metrics

NHC Price/Volume Stats

| Current price | $135.76 | 52-week high | $136.01 |

| Prev. close | $130.79 | 52-week low | $57.90 |

| Day low | $131.74 | Volume | 61,862 |

| Day high | $136.01 | Avg. volume | 64,430 |

| 50-day MA | $110.40 | Dividend yield | 1.86% |

| 200-day MA | $93.27 | Market Cap | 2.09B |

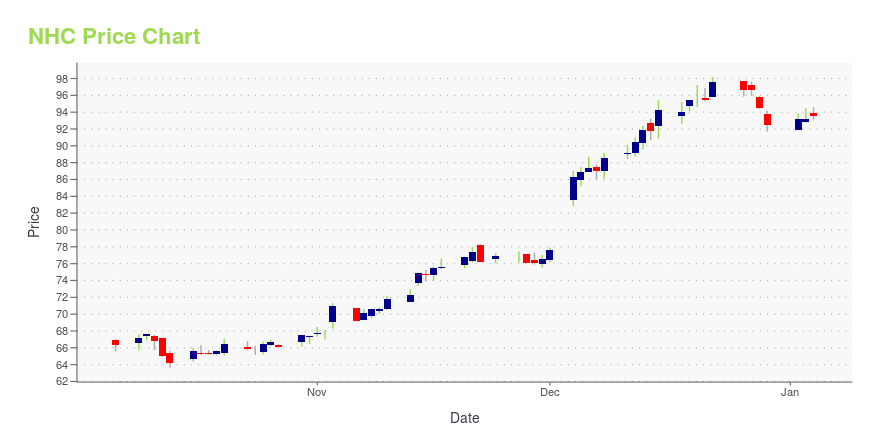

NHC Stock Price Chart Interactive Chart >

National HealthCare Corporation (NHC) Company Bio

National Healthcare Corp. operates, manages, or provides services to skilled nursing facilities and associated assisted living centers, retirement centers, and home health care programs. The company was founded in 1971 and is based in Murfreesboro, Tennessee.

Latest NHC News From Around the Web

Below are the latest news stories about NATIONAL HEALTHCARE CORP that investors may wish to consider to help them evaluate NHC as an investment opportunity.

Insider Sell Alert: Director Emil Hassan Sells 7,500 Shares of National Healthcare Corp (NHC)In a notable insider transaction, Director Emil Hassan has parted with 7,500 shares of National Healthcare Corp (NHC) on December 8, 2023. |

National Healthcare Stock Jumps 12% In 2 Days In Massive VolumeNational Healthcare has put up dazzling numbers the last couple of quarters. The question now is: Can it continue to report 72% to 93% quarterly earnings growth? National Healthcare stock gapped up 11.2% on Monday in massive volume, 978% above average. |

Uber Technologies, Jabil and Builders FirstSource Set to Join S&P 500; Others to Join S&P MidCap 400 and S&P SmallCap 600S&P Dow Jones Indices ("S&P DJI") will make the following changes to the S&P 500, S&P MidCap 400, and S&P SmallCap 600 indices effective prior to the open of trading on Monday, December 18, to coincide with the quarterly rebalance. The changes ensure each index is more representative of its market capitalization range. All companies being added to the S&P 500 are more representative of the large-cap market space, all companies being added to the S&P MidCap 400 are more representative of the mid- |

7 Elder Care Stocks to Take Advantage of Aging AmericaBuy these seven elder care stocks, as each one has ample exposure to the long-term "graying of America" trend. |

National Healthcare Corp (NHC) Reports 6. ...Adjusted Net Income Rises to $13.25M, Marking a Significant Turnaround from Net Loss in Q3 2022 |

NHC Price Returns

| 1-mo | 27.61% |

| 3-mo | 49.58% |

| 6-mo | 40.58% |

| 1-year | 139.15% |

| 3-year | 100.31% |

| 5-year | 84.62% |

| YTD | 48.69% |

| 2023 | 60.84% |

| 2022 | -9.42% |

| 2021 | 5.39% |

| 2020 | -20.65% |

| 2019 | 13.02% |

NHC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NHC

Want to do more research on National Healthcare Corp's stock and its price? Try the links below:National Healthcare Corp (NHC) Stock Price | Nasdaq

National Healthcare Corp (NHC) Stock Quote, History and News - Yahoo Finance

National Healthcare Corp (NHC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...