Natural Health Trends Corp. - Commn Stock (NHTC): Price and Financial Metrics

NHTC Price/Volume Stats

| Current price | $7.00 | 52-week high | $7.40 |

| Prev. close | $7.08 | 52-week low | $5.09 |

| Day low | $7.00 | Volume | 13,100 |

| Day high | $7.10 | Avg. volume | 20,938 |

| 50-day MA | $6.94 | Dividend yield | 11.31% |

| 200-day MA | $6.30 | Market Cap | 80.62M |

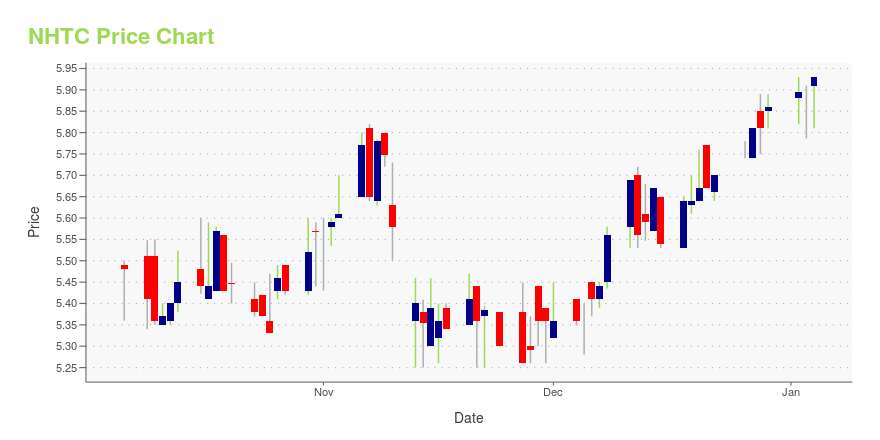

NHTC Stock Price Chart Interactive Chart >

Natural Health Trends Corp. - Commn Stock (NHTC) Company Bio

Natural Health Trends Corporation provides wellness, beauty, and lifestyle products for consumers. The company was founded in 1988 and is based in Dallas, Texas.

Latest NHTC News From Around the Web

Below are the latest news stories about NATURAL HEALTH TRENDS CORP that investors may wish to consider to help them evaluate NHTC as an investment opportunity.

12 Best Debt Free Stocks To BuyIn this article, we discuss the 12 best debt free stocks to buy. If you want to read about some more debt free stocks, go directly to 5 Best Debt Free Stocks To Buy. There are negative connotations associated with debt in the mind of an average person. Debt might not be ideal for individuals […] |

Does Natural Health Trends (NASDAQ:NHTC) Deserve A Spot On Your Watchlist?It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story... |

Natural Health Trends Corp. (NASDAQ:NHTC) Q3 2023 Earnings Call TranscriptNatural Health Trends Corp. (NASDAQ:NHTC) Q3 2023 Earnings Call Transcript November 1, 2023 Operator: Greetings. Welcome to Natural Health Trends Corp. Third Quarter 2023 Earnings Conference Call. [Operator Instructions] Please note, this conference is being recorded. I will now turn the conference over to Michelle Glidewell with Natural Health Trends Corp. Thank you. You may […] |

Q3 2023 Natural Health Trends Corp Earnings CallQ3 2023 Natural Health Trends Corp Earnings Call |

Natural Health Trends Corp (NHTC) Reports Q3 2023 Earnings: Cash Flows Improve by $1.4 MillionDespite a stronger dollar and cautious consumer sentiment, total orders remain steady |

NHTC Price Returns

| 1-mo | 3.18% |

| 3-mo | 9.53% |

| 6-mo | 19.48% |

| 1-year | 38.58% |

| 3-year | 46.58% |

| 5-year | 85.62% |

| YTD | 26.42% |

| 2023 | 96.17% |

| 2022 | -42.12% |

| 2021 | 50.40% |

| 2020 | 6.62% |

| 2019 | -68.63% |

NHTC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NHTC

Here are a few links from around the web to help you further your research on Natural Health Trends Corp's stock as an investment opportunity:Natural Health Trends Corp (NHTC) Stock Price | Nasdaq

Natural Health Trends Corp (NHTC) Stock Quote, History and News - Yahoo Finance

Natural Health Trends Corp (NHTC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...