NIO Inc. ADR (NIO): Price and Financial Metrics

NIO Price/Volume Stats

| Current price | $4.43 | 52-week high | $16.18 |

| Prev. close | $4.27 | 52-week low | $3.61 |

| Day low | $4.24 | Volume | 32,103,300 |

| Day high | $4.43 | Avg. volume | 53,454,859 |

| 50-day MA | $4.72 | Dividend yield | N/A |

| 200-day MA | $6.00 | Market Cap | 7.62B |

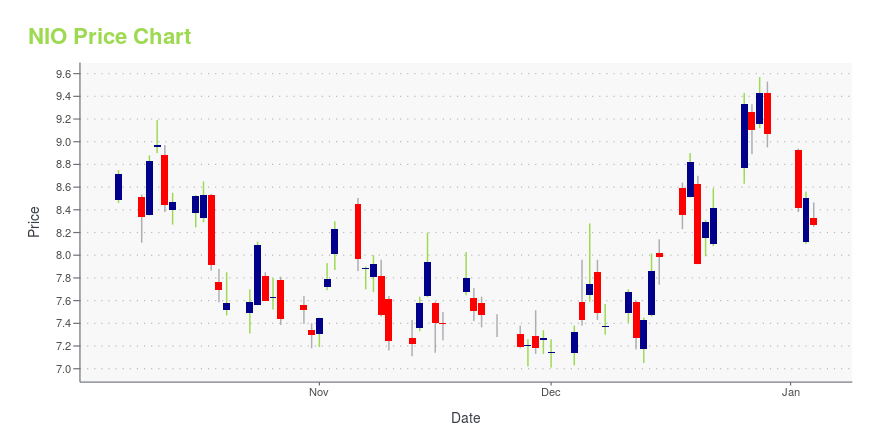

NIO Stock Price Chart Interactive Chart >

NIO Inc. ADR (NIO) Company Bio

Founded in 2014 by Bin Li and Qin Li Hong, NIO, Inc. is a Chinese based electric vehicle designer and manufacturer, headquartered in Jiading, China. The company is also engaged in the development of artificial intelligence, autonomous driving, and next generation connectivity solutions. In 2016, NIO developed its first electric vehicle, the EP9 supercar and over the next three years, NIO introduced two additional models to the market, the ES8 and the ES6. The ES8 is a 7-seater all aluminum alloy body, electric SUV that focuses on performance, functionality, and mobility lifestyle. The ES6 is a 5-seater premium electric SUV that hit the market in June 2019. Bin Li currently serves as NIO’s chairman and Chief Executive Officer and the company employs over 7,700 individuals as of 2020.

Latest NIO News From Around the Web

Below are the latest news stories about NIO INC that investors may wish to consider to help them evaluate NIO as an investment opportunity.

Good News! Why Top China EV Play Li Auto Is Just Getting Started.For long-term investors bullish on the rise of EVs in China, LI stock remains a standout choice among U.S.-listed names in the space. |

Tesla Forecast: Why 2024 Will Be Decisive for TSLA StockEntering 2024, TSLA stock ride the wave as the company chases global domination, but Elon Musk could be on the edge of total collapse. |

Best EV Stock 2024: Nio Stock vs. Lucid StockNio and Lucid are ramping up their production and delivery of electric vehicles in 2024. |

12 High Growth International Stocks to BuyIn this article, we discuss the 12 high growth international stocks to buy. If you want to read about some more high growth international stocks, go directly to 5 High Growth International Stocks to Buy. There is general optimism on Wall Street that the Federal Reserve in the United States will be able to achieve […] |

Most Active Equity Options For Midday - Wednesday, Dec. 27Here are the most active equity options for midday. |

NIO Price Returns

| 1-mo | -4.53% |

| 3-mo | -1.34% |

| 6-mo | -27.85% |

| 1-year | -66.54% |

| 3-year | -88.74% |

| 5-year | 26.21% |

| YTD | -51.16% |

| 2023 | -6.97% |

| 2022 | -69.22% |

| 2021 | -35.00% |

| 2020 | 1,112.44% |

| 2019 | -36.89% |

Loading social stream, please wait...