Nokia Corp. ADR (NOK): Price and Financial Metrics

NOK Price/Volume Stats

| Current price | $4.75 | 52-week high | $5.48 |

| Prev. close | $4.78 | 52-week low | $3.61 |

| Day low | $4.73 | Volume | 21,013,600 |

| Day high | $4.81 | Avg. volume | 19,627,043 |

| 50-day MA | $5.18 | Dividend yield | 2.51% |

| 200-day MA | $0.00 | Market Cap | 25.56B |

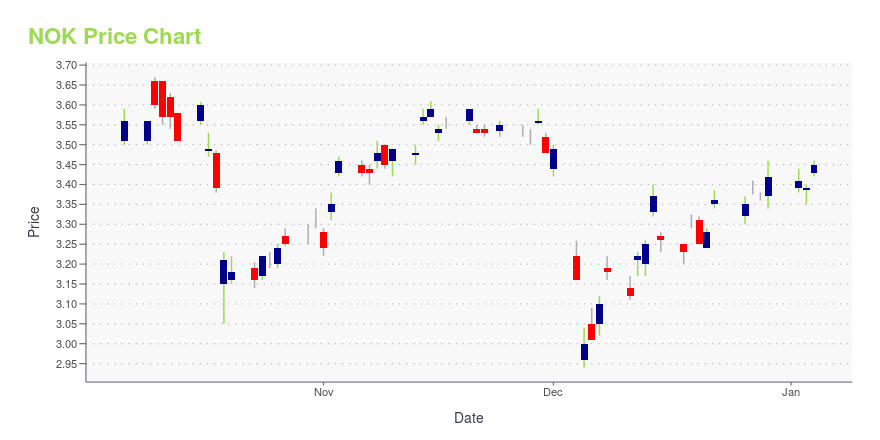

NOK Stock Price Chart Interactive Chart >

Nokia Corp. ADR (NOK) Company Bio

Nokia Corporation (natively Nokia Oyj, referred to as Nokia; stylized as NOKIA) is a Finnish multinational telecommunications, information technology, and consumer electronics corporation, established in 1865. Nokia's main headquarters are in Espoo, Finland, in the greater Helsinki metropolitan area, but the company's actual roots are in the Tampere region of Pirkanmaa. In 2020, Nokia employed approximately 92,000 people across over 100 countries, did business in more than 130 countries, and reported annual revenues of around €23 billion. Nokia is a public limited company listed on the Helsinki Stock Exchange and New York Stock Exchange. It is the world's 415th-largest company measured by 2016 revenues according to the Fortune Global 500, having peaked at 85th place in 2009. It is a component of the Euro Stoxx 50 stock market index. (Source:Wikipedia)

NOK Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 32.86% |

| 3-year | 7.42% |

| 5-year | 13.75% |

| YTD | 8.36% |

| 2024 | 32.68% |

| 2023 | -24.77% |

| 2022 | -24.75% |

| 2021 | 59.08% |

| 2020 | 5.39% |

NOK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NOK

Want to see what other sources are saying about Nokia Corp's financials and stock price? Try the links below:Nokia Corp (NOK) Stock Price | Nasdaq

Nokia Corp (NOK) Stock Quote, History and News - Yahoo Finance

Nokia Corp (NOK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...