Northern Trust Corp. (NTRS): Price and Financial Metrics

NTRS Price/Volume Stats

| Current price | $89.43 | 52-week high | $92.46 |

| Prev. close | $87.98 | 52-week low | $62.44 |

| Day low | $88.49 | Volume | 776,700 |

| Day high | $89.65 | Avg. volume | 1,383,531 |

| 50-day MA | $84.36 | Dividend yield | 3.47% |

| 200-day MA | $80.95 | Market Cap | 18.30B |

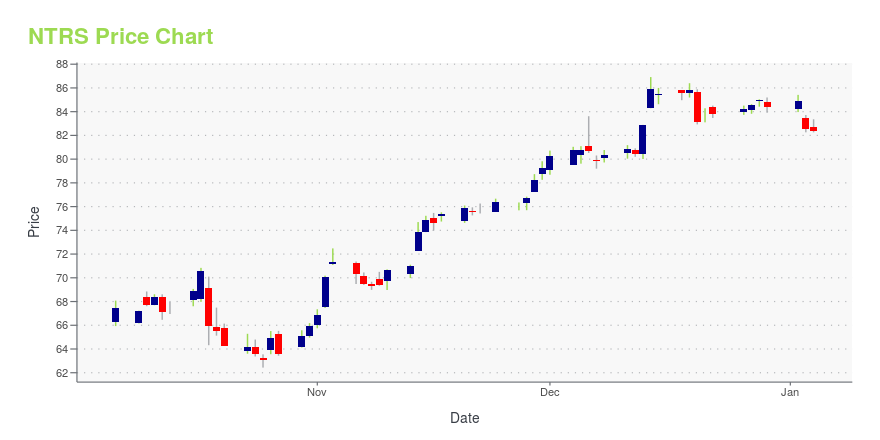

NTRS Stock Price Chart Interactive Chart >

Northern Trust Corp. (NTRS) Company Bio

Northern Trust Corporation is a financial services company headquartered in Chicago that caters to corporations, institutional investors, and ultra high net worth individuals. Northern Trust is one of the largest banking institutions in the United States and one of the oldest banks in continuous operation. As of June 30, 2021, it had $1.5 trillion in assets under management and $15.7 trillion in assets under custody. Northern Trust Corporation is incorporated in Delaware. (Source:Wikipedia)

Latest NTRS News From Around the Web

Below are the latest news stories about NORTHERN TRUST CORP that investors may wish to consider to help them evaluate NTRS as an investment opportunity.

Northern Trust's Culture of Shared ValuesNORTHAMPTON, MA / ACCESSWIRE / December 27, 2023 / Northern Trust Originally published in Northern Trust's 2022 Sustainability Report Since our founding in 1889, Northern Trust has actively advanced a culture of caring and a commitment to invest responsibly ... |

Is FlexShares International Quality Dividend ETF (IQDF) a Strong ETF Right Now?Smart Beta ETF report for IQDF |

Northern Trust Diversity, Equity, and Inclusion Strategy Commits to Advancing Inclusive CultureNORTHAMPTON, MA / ACCESSWIRE / December 21, 2023 / Northern Trust Originally published in Northern Trust's 2022 Sustainability Report We are committed to advancing an inclusive culture in which all individuals are valued, respected, supported and ... |

Northern Trust Women’s Leadership Development ForumNORTHAMPTON, MA / ACCESSWIRE / December 19, 2023 / Northern Trust Originally published in Northern Trust's 2022 Sustainability Report The Women's Leadership Development Forum is focused on the development of women at the middle management levels. ... |

Is FlexShares Quality Dividend ETF (QDF) a Strong ETF Right Now?Smart Beta ETF report for QDF |

NTRS Price Returns

| 1-mo | 8.35% |

| 3-mo | 8.24% |

| 6-mo | 12.04% |

| 1-year | 15.98% |

| 3-year | -11.89% |

| 5-year | 5.73% |

| YTD | 7.95% |

| 2023 | -1.02% |

| 2022 | -23.82% |

| 2021 | 31.65% |

| 2020 | -9.29% |

| 2019 | 30.59% |

NTRS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NTRS

Want to see what other sources are saying about Northern Trust Corp's financials and stock price? Try the links below:Northern Trust Corp (NTRS) Stock Price | Nasdaq

Northern Trust Corp (NTRS) Stock Quote, History and News - Yahoo Finance

Northern Trust Corp (NTRS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...