Northwest Bancshares, Inc. (NWBI): Price and Financial Metrics

NWBI Price/Volume Stats

| Current price | $14.26 | 52-week high | $14.55 |

| Prev. close | $14.16 | 52-week low | $9.80 |

| Day low | $14.10 | Volume | 858,787 |

| Day high | $14.55 | Avg. volume | 748,559 |

| 50-day MA | $11.60 | Dividend yield | 5.75% |

| 200-day MA | $11.48 | Market Cap | 1.81B |

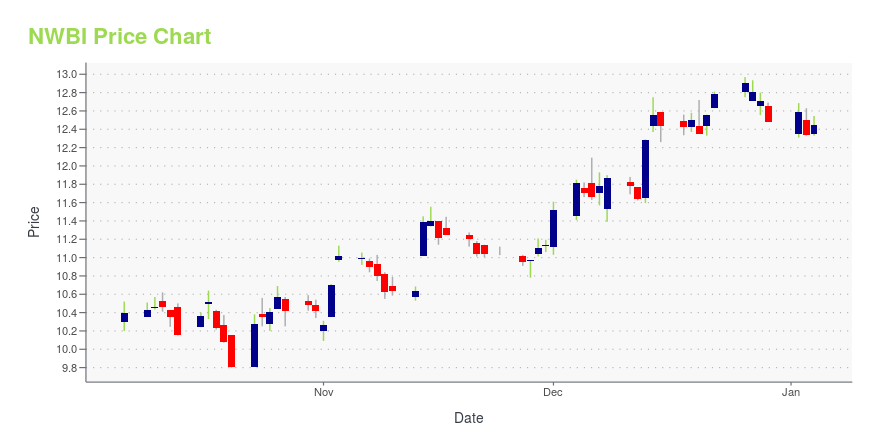

NWBI Stock Price Chart Interactive Chart >

Northwest Bancshares, Inc. (NWBI) Company Bio

Northwest Bancshares operates as a bank holding company for Northwest Savings Bank that offers various personal and business banking solutions in the United States. The company operates through two segments, Community Banking and Consumer Finance. The company has branches across Pennsylvania, Western New York, Eastern Ohio, and Maryland. The company was founded in 1896 and is based in Warren, Pennsylvania.

Latest NWBI News From Around the Web

Below are the latest news stories about NORTHWEST BANCSHARES INC that investors may wish to consider to help them evaluate NWBI as an investment opportunity.

Strength Seen in Northwest Bancshares (NWBI): Can Its 5.5% Jump Turn into More Strength?Northwest Bancshares (NWBI) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road. |

Recent uptick might appease Northwest Bancshares, Inc. (NASDAQ:NWBI) institutional owners after losing 13% over the past yearKey Insights Institutions' substantial holdings in Northwest Bancshares implies that they have significant influence... |

Can Northwest Bancshares (NWBI) Run Higher on Rising Earnings Estimates?Northwest Bancshares (NWBI) shares have started gaining and might continue moving higher in the near term, as indicated by solid earnings estimate revisions. |

12 Best Dividend Stocks Under $20In this article, we discuss 12 best dividend stocks under $20. You can skip our detailed analysis of dividend stocks and their performance in the past, and go directly to read 5 Best Dividend Stocks Under $20. In 2023, dividend-paying stocks faced difficulties, but experienced investors understand that short-term setbacks don’t deter them. They know […] |

Northwest Bancshares, Inc. (NASDAQ:NWBI) Will Pay A US$0.20 Dividend In Four DaysNorthwest Bancshares, Inc. ( NASDAQ:NWBI ) stock is about to trade ex-dividend in four days. The ex-dividend date is... |

NWBI Price Returns

| 1-mo | 28.82% |

| 3-mo | 34.33% |

| 6-mo | 13.90% |

| 1-year | 25.52% |

| 3-year | 32.80% |

| 5-year | 13.21% |

| YTD | 18.37% |

| 2023 | -4.38% |

| 2022 | 4.60% |

| 2021 | 17.77% |

| 2020 | -18.03% |

| 2019 | 2.36% |

NWBI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NWBI

Here are a few links from around the web to help you further your research on Northwest Bancshares Inc's stock as an investment opportunity:Northwest Bancshares Inc (NWBI) Stock Price | Nasdaq

Northwest Bancshares Inc (NWBI) Stock Quote, History and News - Yahoo Finance

Northwest Bancshares Inc (NWBI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...