OceanFirst Financial Corp. (OCFC): Price and Financial Metrics

OCFC Price/Volume Stats

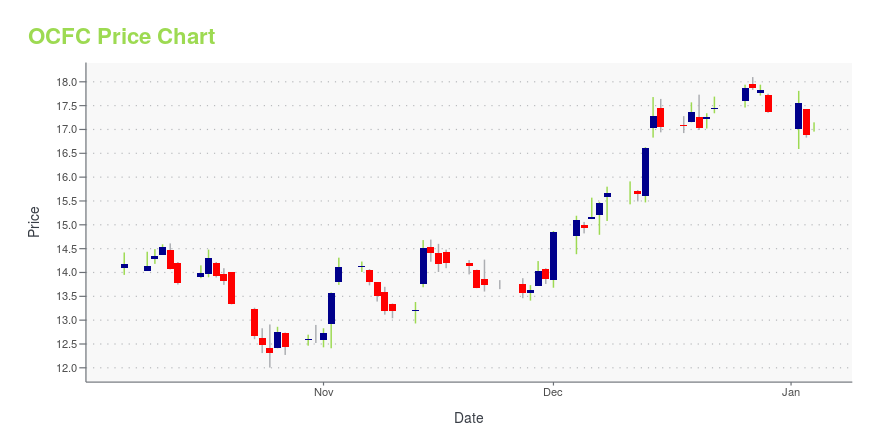

| Current price | $18.58 | 52-week high | $19.58 |

| Prev. close | $18.37 | 52-week low | $12.01 |

| Day low | $18.16 | Volume | 271,400 |

| Day high | $18.79 | Avg. volume | 318,908 |

| 50-day MA | $15.74 | Dividend yield | 4.4% |

| 200-day MA | $15.47 | Market Cap | 1.09B |

OCFC Stock Price Chart Interactive Chart >

OceanFirst Financial Corp. (OCFC) Company Bio

OceanFirst Financial Corporation provides a range of community banking services to retail, government, and business customers in New Jersey. The company was founded in 1902 and is based in Toms River, New Jersey.

Latest OCFC News From Around the Web

Below are the latest news stories about OCEANFIRST FINANCIAL CORP that investors may wish to consider to help them evaluate OCFC as an investment opportunity.

After losing 32% in the past year, OceanFirst Financial Corp. (NASDAQ:OCFC) institutional owners must be relieved by the recent gainKey Insights Institutions' substantial holdings in OceanFirst Financial implies that they have significant influence... |

OceanFirst Financial (NASDAQ:OCFC) Has Affirmed Its Dividend Of $0.20OceanFirst Financial Corp.'s ( NASDAQ:OCFC ) investors are due to receive a payment of $0.20 per share on 17th of... |

OceanFirst Financial Corp. (NASDAQ:OCFC) Q3 2023 Earnings Call TranscriptOceanFirst Financial Corp. (NASDAQ:OCFC) Q3 2023 Earnings Call Transcript October 20, 2023 Operator: Hello, all and welcome to OceanFirst Financial Corp’s Third Quarter 2023 Earnings Call. My name is Lidya and I’ll be your operator today. [Operator Instructions] I’ll now hand you over to your host, Alfred Goon, SVP of Corporate Development and Investor Relations […] |

Pleasing Signs As A Number Of Insiders Buy OceanFirst Financial StockGenerally, when a single insider buys stock, it is usually not a big deal. However, when several insiders are buying... |

Q3 2023 OceanFirst Financial Corp Earnings CallQ3 2023 OceanFirst Financial Corp Earnings Call |

OCFC Price Returns

| 1-mo | 22.16% |

| 3-mo | 22.47% |

| 6-mo | 3.93% |

| 1-year | 3.79% |

| 3-year | 7.70% |

| 5-year | -6.25% |

| YTD | 9.74% |

| 2023 | -14.23% |

| 2022 | -0.85% |

| 2021 | 23.13% |

| 2020 | -24.11% |

| 2019 | 16.70% |

OCFC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching OCFC

Want to do more research on Oceanfirst Financial Corp's stock and its price? Try the links below:Oceanfirst Financial Corp (OCFC) Stock Price | Nasdaq

Oceanfirst Financial Corp (OCFC) Stock Quote, History and News - Yahoo Finance

Oceanfirst Financial Corp (OCFC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...