Grupo Aeroportuario del Centro Norte S.A.B. de C.V. ADR (OMAB): Price and Financial Metrics

OMAB Price/Volume Stats

| Current price | $69.33 | 52-week high | $100.21 |

| Prev. close | $69.24 | 52-week low | $50.23 |

| Day low | $67.82 | Volume | 37,278 |

| Day high | $70.49 | Avg. volume | 52,910 |

| 50-day MA | $73.58 | Dividend yield | 6.44% |

| 200-day MA | $73.99 | Market Cap | 2.95B |

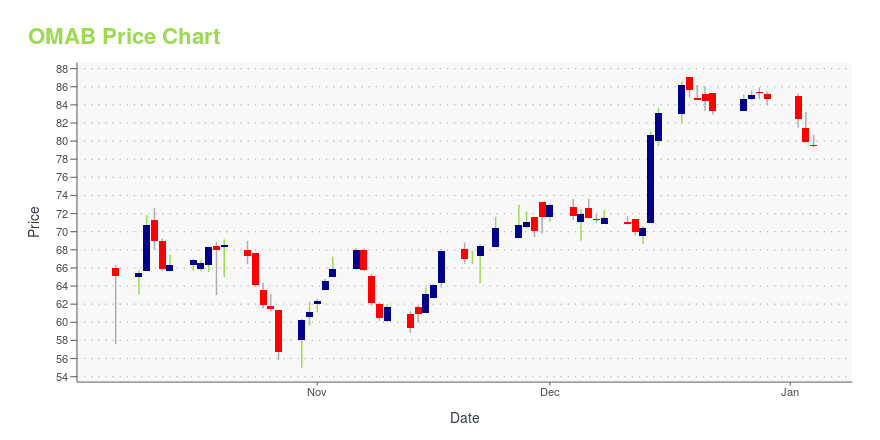

OMAB Stock Price Chart Interactive Chart >

Grupo Aeroportuario del Centro Norte S.A.B. de C.V. ADR (OMAB) Company Bio

Grupo Aeroportuario del Centro operates 13 international airports in nine states of central and northern Mexico. The company is based in San Pedro Garza García, Mexico.

Latest OMAB News From Around the Web

Below are the latest news stories about CENTRAL NORTH AIRPORT GROUP that investors may wish to consider to help them evaluate OMAB as an investment opportunity.

Emerging Market Marvels: 7 Stocks Set to Soar in Developing EconomiesThe past few years have been all about U.S. tech stocks. |

Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. (NASDAQ:OMAB) Q3 2023 Earnings Call TranscriptGrupo Aeroportuario del Centro Norte, S.A.B. de C.V. (NASDAQ:OMAB) Q3 2023 Earnings Call Transcript October 30, 2023 Operator: Greetings and welcome to the OMA Third Quarter Conference Call. At this time all participants are in a listen-only mode. A question-and-answer session will follow the formal presentation. [Operator Instructions] As a reminder, this conference is being […] |

The 3 Most Undervalued Momentum Stocks to Buy in September 2023But sometimes, the best prospects lie in a stock that is already making highs and set to keep on climbing. |

The 3 Most Undervalued Mid-Cap Stocks to Buy Now: August 2023Mid-cap stocks are in the market's sweet spot. |

Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. (NASDAQ:OMAB) Q4 2022 Earnings Call TranscriptGrupo Aeroportuario del Centro Norte, S.A.B. de C.V. (NASDAQ:OMAB) Q4 2022 Earnings Call Transcript February 17, 2023 Operator: Greetings and welcome to the Grupo Aeroportuario del Centro Norte OMA Fourth Quarter 2022 Earnings Call. As a reminder, this conference is being recorded. I would now like to turn the conference over to your host, Emmanuel […] |

OMAB Price Returns

| 1-mo | 2.39% |

| 3-mo | -19.27% |

| 6-mo | -4.13% |

| 1-year | -19.42% |

| 3-year | 80.93% |

| 5-year | 70.86% |

| YTD | -15.94% |

| 2023 | 43.07% |

| 2022 | 28.31% |

| 2021 | 7.47% |

| 2020 | -13.78% |

| 2019 | 62.44% |

OMAB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching OMAB

Want to do more research on Central North Airport Group's stock and its price? Try the links below:Central North Airport Group (OMAB) Stock Price | Nasdaq

Central North Airport Group (OMAB) Stock Quote, History and News - Yahoo Finance

Central North Airport Group (OMAB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...