OP Bancorp (OPBK): Price and Financial Metrics

OPBK Price/Volume Stats

| Current price | $12.50 | 52-week high | $12.82 |

| Prev. close | $12.05 | 52-week low | $8.23 |

| Day low | $12.31 | Volume | 269,362 |

| Day high | $12.82 | Avg. volume | 28,710 |

| 50-day MA | $10.03 | Dividend yield | 4.13% |

| 200-day MA | $9.83 | Market Cap | 186.50M |

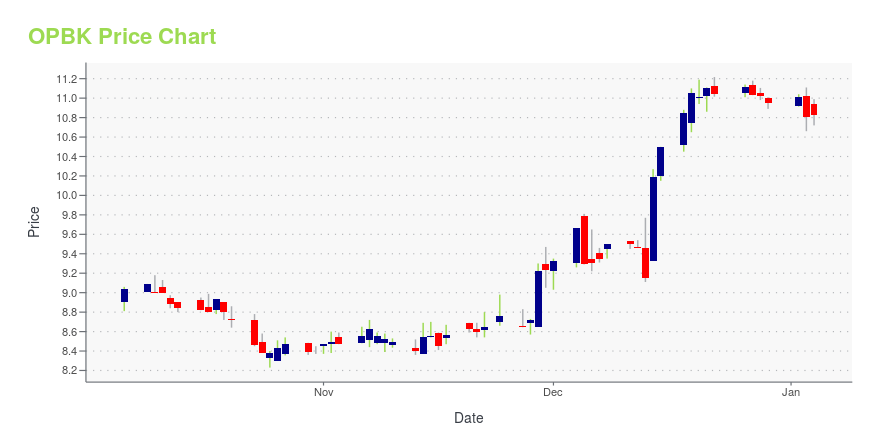

OPBK Stock Price Chart Interactive Chart >

OP Bancorp (OPBK) Company Bio

OP Bancorp operates as the bank holding company for Open Bank that provides banking products and services in California. The company was founded in 2005 and is based in Los Angeles, California.

Latest OPBK News From Around the Web

Below are the latest news stories about OP BANCORP that investors may wish to consider to help them evaluate OPBK as an investment opportunity.

OP Bancorp (NASDAQ:OPBK) has caught the attention of institutional investors who hold a sizeable 45% stakeKey Insights Given the large stake in the stock by institutions, OP Bancorp's stock price might be vulnerable to their... |

Investors in OP Bancorp (NASDAQ:OPBK) have seen respectable returns of 40% over the past three yearsOne simple way to benefit from the stock market is to buy an index fund. But if you buy good businesses at attractive... |

Zacks Value Trader Highlights: Citizens Community Bancorp, FinWise Bancorp, First Bank, NorthEast Community Bancorp and OP BancorCitizens Community Bancorp, FinWise Bancorp, First Bank, NorthEast Community Bancorp and OP Bancor are part of the Zacks Value Trader blog. |

Are Investors Undervaluing OP Bancorp (OPBK) Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

5 Cheap Strong Buy Bank Stocks in 2023Are you ready to look at the community banks again? |

OPBK Price Returns

| 1-mo | 31.30% |

| 3-mo | 35.44% |

| 6-mo | 12.82% |

| 1-year | 36.42% |

| 3-year | 33.87% |

| 5-year | 55.44% |

| YTD | 16.94% |

| 2023 | 3.24% |

| 2022 | -9.30% |

| 2021 | 70.96% |

| 2020 | -22.79% |

| 2019 | 19.39% |

OPBK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching OPBK

Want to do more research on OP Bancorp's stock and its price? Try the links below:OP Bancorp (OPBK) Stock Price | Nasdaq

OP Bancorp (OPBK) Stock Quote, History and News - Yahoo Finance

OP Bancorp (OPBK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...