Oppenheimer Holdings, Inc. (DE) (OPY): Price and Financial Metrics

OPY Price/Volume Stats

| Current price | $52.94 | 52-week high | $58.35 |

| Prev. close | $57.94 | 52-week low | $32.82 |

| Day low | $52.10 | Volume | 138,597 |

| Day high | $57.45 | Avg. volume | 38,638 |

| 50-day MA | $48.17 | Dividend yield | 1.09% |

| 200-day MA | $41.24 | Market Cap | 546.82M |

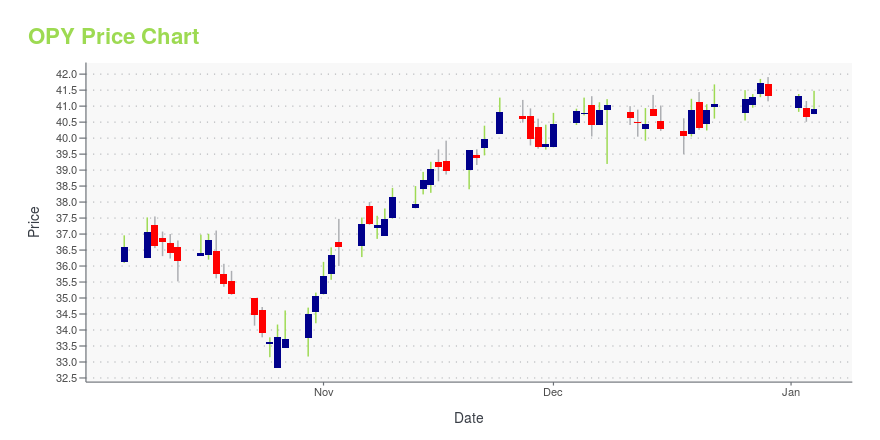

OPY Stock Price Chart Interactive Chart >

Oppenheimer Holdings, Inc. (DE) (OPY) Company Bio

Oppenheimer Holdings provides a full range of wealth management, securities brokerage and investment banking services to high-net-worth individuals, families, corporate executives, local governments, businesses and institutions. The company was founded in 1881 and is based in New York, New York.

Latest OPY News From Around the Web

Below are the latest news stories about OPPENHEIMER HOLDINGS INC that investors may wish to consider to help them evaluate OPY as an investment opportunity.

Why Microsoft Stock Is A Top Pick For 2024As we head into a New Year, analysts across Wall Street are naming tech giant Microsoft a top stock pick for 2024. |

Best Blue-Chip Stocks 2024: 7 to Add to Your Must-Buy ListWhile mega-cap technology stocks led the way over the past year, the market rally is now maturing and broadening out to include other securities. |

The 10 Best Invesco Mutual Funds to Buy NowInvesco mutual funds offer investors a diverse range of investment options to help them achieve their financial goals. With a long-standing reputation and a wide variety of funds, Invesco has established itself as a trusted name in the investment industry. |

‘Oppenheimer’ to be released in Japan after delay following ‘Barbenheimer’ controversyCinemagoers in Japan will soon be able to see box office hit “Oppenheimer,” months after much of the rest of the world. |

'Oppenheimer' to screen in Japan next year after nuclear controversyUniversal Pictures' "Oppenheimer" will screen in Japan next year, a local distributor said on Thursday - a launch that had been in doubt amid criticism that the film largely ignores the devastation of the atomic bombings of the cities of Hiroshima and Nagasaki. The Christopher Nolan-directed biopic about atomic bomb pioneer J. Robert Oppenheimer has grossed over $950 million globally since its July opening. The film will open in Japan in 2024, distributor Bitters End said in a statement, noting that the movie is "considered a front runner for various film awards." |

OPY Price Returns

| 1-mo | 13.43% |

| 3-mo | 30.22% |

| 6-mo | 37.29% |

| 1-year | 33.11% |

| 3-year | 31.99% |

| 5-year | 107.40% |

| YTD | 29.08% |

| 2023 | -0.89% |

| 2022 | -6.83% |

| 2021 | 52.69% |

| 2020 | 20.41% |

| 2019 | 9.39% |

OPY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching OPY

Want to do more research on Oppenheimer Holdings Inc's stock and its price? Try the links below:Oppenheimer Holdings Inc (OPY) Stock Price | Nasdaq

Oppenheimer Holdings Inc (OPY) Stock Quote, History and News - Yahoo Finance

Oppenheimer Holdings Inc (OPY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...