Oracle Corporation (ORCL): Price and Financial Metrics

ORCL Price/Volume Stats

| Current price | $139.01 | 52-week high | $146.59 |

| Prev. close | $137.82 | 52-week low | $99.26 |

| Day low | $138.38 | Volume | 5,139,300 |

| Day high | $139.96 | Avg. volume | 8,497,073 |

| 50-day MA | $134.18 | Dividend yield | 1.12% |

| 200-day MA | $118.63 | Market Cap | 383.09B |

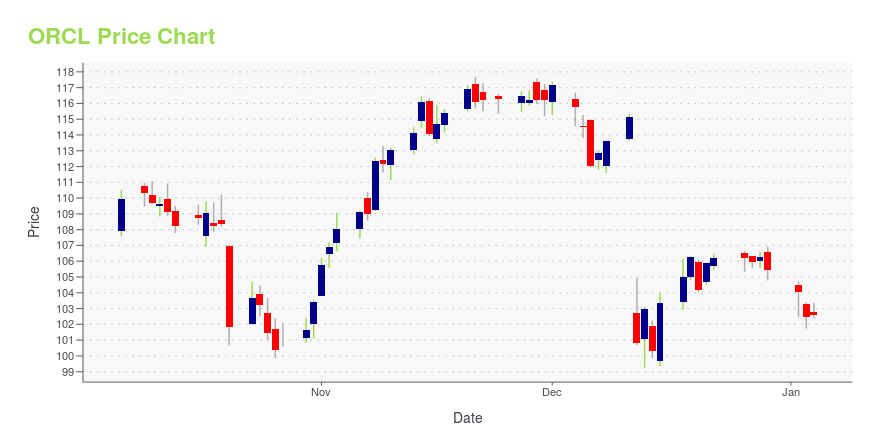

ORCL Stock Price Chart Interactive Chart >

Oracle Corporation (ORCL) Company Bio

Oracle Corporation develops, manufactures, markets, sells, hosts, and supports database and middleware software, application software, cloud infrastructure, hardware systems, and related services worldwide. The company was founded in 1977 and is based in Redwood City, California.

Latest ORCL News From Around the Web

Below are the latest news stories about ORACLE CORP that investors may wish to consider to help them evaluate ORCL as an investment opportunity.

Top 7 Semiconductor Stock Picks for the New YearSemiconductors are in the early stages of a super cycle and these seven semiconductor stock picks are expected to stand out in 2024 |

The Zacks Analyst Blog Highlights NVIDIA, Oracle, The TJX Companies, Chubb and XylemNVIDIA, Oracle, The TJX Companies, Chubb and Xylem are part of the Zacks top Analyst Blog . |

These 2 Computer and Technology Stocks Could Beat Earnings: Why They Should Be on Your RadarWhy investors should use the Zacks Earnings ESP tool to help find stocks that are poised to top quarterly earnings estimates. |

Top Stock Reports for NVIDIA, Oracle & The TJX CompaniesToda's Research Daily features new research reports on 16 major stocks, including NVIDIA Corporation (NVDA), Oracle Corporation (ORCL) and The TJX Companies, Inc. (TJX). |

Why AMD Stock Is a Buy Even Though It Won’t Beat Nvidia in AIThe battle for AI chip supremacy is just getting started and already AMD stock is reaping the benefits of its technological advances. |

ORCL Price Returns

| 1-mo | 0.85% |

| 3-mo | 18.93% |

| 6-mo | 21.99% |

| 1-year | 21.06% |

| 3-year | 65.72% |

| 5-year | 157.25% |

| YTD | 33.16% |

| 2023 | 30.94% |

| 2022 | -4.65% |

| 2021 | 36.89% |

| 2020 | 24.25% |

| 2019 | 19.34% |

ORCL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ORCL

Here are a few links from around the web to help you further your research on Oracle Corp's stock as an investment opportunity:Oracle Corp (ORCL) Stock Price | Nasdaq

Oracle Corp (ORCL) Stock Quote, History and News - Yahoo Finance

Oracle Corp (ORCL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...