Ontrak, Inc. (OTRK): Price and Financial Metrics

OTRK Price/Volume Stats

| Current price | $0.26 | 52-week high | $2.71 |

| Prev. close | $0.25 | 52-week low | $0.14 |

| Day low | $0.26 | Volume | 207,753 |

| Day high | $0.27 | Avg. volume | 3,326,583 |

| 50-day MA | $0.24 | Dividend yield | N/A |

| 200-day MA | $0.38 | Market Cap | 12.48M |

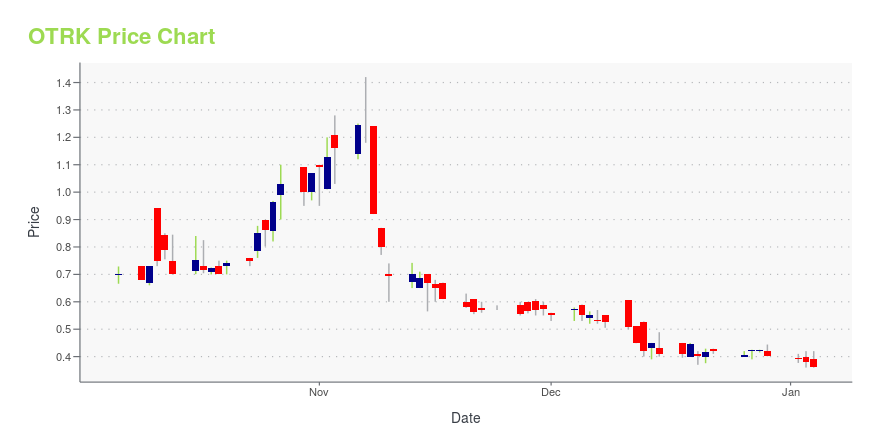

OTRK Stock Price Chart Interactive Chart >

Ontrak, Inc. (OTRK) Company Bio

Ontrak, Inc. operates as a health care technology company. The Company develops platform to improve behavioral health conditions that cause and exacerbate chronic medical diseases such as diabetes, hypertension, coronary artery, and congestive heart failure. Ontrak serves customers in the United States.

Latest OTRK News From Around the Web

Below are the latest news stories about ONTRAK INC that investors may wish to consider to help them evaluate OTRK as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayIt's time to start the week with a breakdown of the biggest pre-market stock movers worth keeping an eye on for Monday morning! |

Ontrak, Inc. (NASDAQ:OTRK) Q3 2023 Earnings Call TranscriptOntrak, Inc. (NASDAQ:OTRK) Q3 2023 Earnings Call Transcript November 14, 2023 Operator: Good day, and thank you for standing by, and welcome to the Ontrak Third Quarter ’23 Earnings Conference Call. At this time, all participants are in listen-only mode. After the speakers’ presentation, there will be a question-and-answer session. [Operator Instructions] Please be advised […] |

Ontrak Announces 2023 Third Quarter Financial ResultsMIAMI, November 14, 2023--Ontrak, Inc. (NASDAQ: OTRK) ("Ontrak" or the "Company"), a leading AI-powered and telehealth-enabled healthcare company, today reported its financial results for the third quarter ended September 30, 2023. |

Ontrak, Inc. Announces Closing of $6.3 Million Public Offering, $11 Million Concurrent Private Placement and $16.3 Million Conversion of Secured NotesMIAMI, November 14, 2023--Ontrak, Inc. (NASDAQ: OTRK) ("Ontrak" or the "Company"), a leading AI-powered and telehealth-enabled healthcare company, today announced the closing of its previously announced public offering of: |

Ontrak, Inc. Announces Pricing of $6.3 Million Public Offering, $11 Million Concurrent Private Placement and $16.3 Million Conversion of Secured NotesMIAMI, November 10, 2023--Ontrak, Inc. (NASDAQ: OTRK) ("Ontrak" or the "Company"), a leading AI-powered and telehealth-enabled healthcare company, today announced the pricing of a public offering of: |

OTRK Price Returns

| 1-mo | 22.70% |

| 3-mo | -11.26% |

| 6-mo | 9.06% |

| 1-year | -88.89% |

| 3-year | -99.84% |

| 5-year | -99.75% |

| YTD | -35.16% |

| 2023 | -81.82% |

| 2022 | -94.16% |

| 2021 | -89.82% |

| 2020 | 278.85% |

| 2019 | 74.07% |

Loading social stream, please wait...