Otter Tail Corporation (OTTR): Price and Financial Metrics

OTTR Price/Volume Stats

| Current price | $100.47 | 52-week high | $100.84 |

| Prev. close | $97.44 | 52-week low | $68.96 |

| Day low | $97.96 | Volume | 344,723 |

| Day high | $100.84 | Avg. volume | 227,895 |

| 50-day MA | $89.46 | Dividend yield | 1.94% |

| 200-day MA | $84.78 | Market Cap | 4.20B |

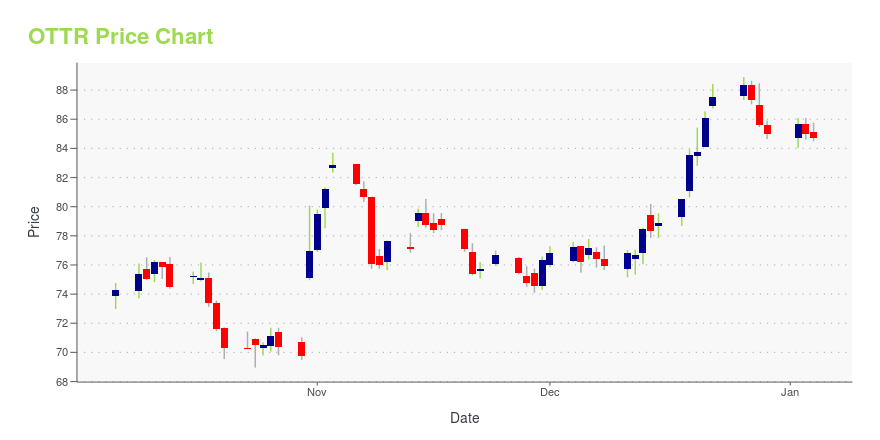

OTTR Stock Price Chart Interactive Chart >

Otter Tail Corporation (OTTR) Company Bio

Otter Tail Corporation engages electric utility and infrastructure businesses in the United States, Canada, and Mexico. The company was founded in 1907 and is based in Fergus Falls, Minnesota.

Latest OTTR News From Around the Web

Below are the latest news stories about OTTER TAIL CORP that investors may wish to consider to help them evaluate OTTR as an investment opportunity.

Otter Tail (OTTR): Strong Industry, Solid Earnings Estimate RevisionsOtter Tail (OTTR) has seen solid earnings estimate revision activity over the past month, and belongs to a strong industry as well. |

3 Utilities to Strengthen Your Portfolio in 2024Consolidated Water (CWCO), Otter Tail (OTTR) and SJW Group (SJW), with their investment plans, rising earnings estimates and regular dividend payments, will strengthen investors' portfolios in 2024. |

Reasons to Add Otter Tail (OTTR) to Your Portfolio Right NowOtter Tail (OTTR), with its steadily increasing earnings estimates and investments, presents a strong case for investment in the utility sector. |

Otter Tail's (NASDAQ:OTTR) three-year earnings growth trails the 26% YoY shareholder returnsOne simple way to benefit from the stock market is to buy an index fund. But if you pick the right individual stocks... |

Sidoti Events, LLC's Virtual December Small-Cap ConferenceNEW YORK, NY / ACCESSWIRE / December 5, 2023 / Sidoti Events, LLC, an affiliate of Sidoti & Company, LLC, has released the presentation schedule and weblinks for its two-day December Small-Cap Conference taking place Wednesday and Thursday, December ... |

OTTR Price Returns

| 1-mo | 16.55% |

| 3-mo | 19.39% |

| 6-mo | 14.85% |

| 1-year | 25.33% |

| 3-year | 114.88% |

| 5-year | 116.74% |

| YTD | 19.47% |

| 2023 | 48.10% |

| 2022 | -15.62% |

| 2021 | 72.84% |

| 2020 | -14.06% |

| 2019 | 6.24% |

OTTR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching OTTR

Want to do more research on Otter Tail Corp's stock and its price? Try the links below:Otter Tail Corp (OTTR) Stock Price | Nasdaq

Otter Tail Corp (OTTR) Stock Quote, History and News - Yahoo Finance

Otter Tail Corp (OTTR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...