Ohio Valley Banc Corp. (OVBC): Price and Financial Metrics

OVBC Price/Volume Stats

| Current price | $23.20 | 52-week high | $25.95 |

| Prev. close | $23.06 | 52-week low | $19.35 |

| Day low | $22.78 | Volume | 633 |

| Day high | $23.41 | Avg. volume | 2,576 |

| 50-day MA | $22.16 | Dividend yield | 3.83% |

| 200-day MA | $23.44 | Market Cap | 111.22M |

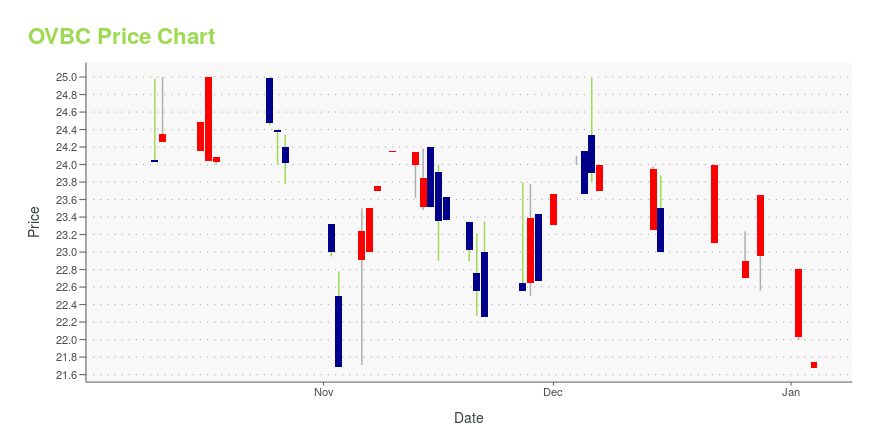

OVBC Stock Price Chart Interactive Chart >

Ohio Valley Banc Corp. (OVBC) Company Bio

Ohio Valley Banc Corp. operates as the bank holding company for The Ohio Valley Bank Company that provides commercial and consumer banking products and services in southeastern Ohio and western West Virginia. The company was founded in 1872 and is based in Gallipolis, Ohio.

Latest OVBC News From Around the Web

Below are the latest news stories about OHIO VALLEY BANC CORP that investors may wish to consider to help them evaluate OVBC as an investment opportunity.

Individual investors account for 60% of Ohio Valley Banc Corp.'s (NASDAQ:OVBC) ownership, while institutions account for 15%Key Insights Significant control over Ohio Valley Banc by individual investors implies that the general public has more... |

Ohio Valley Banc Corp. Reports 3rd Quarter EarningsOhio Valley Banc Corp. [Nasdaq: OVBC] (the "Company") reported consolidated net income for the quarter ended September 30, 2023, of $2,251,000, a decrease of $1,439,000 from the same period the prior year. Earnings per share for the third quarter of 2023 were $.47 compared to $.77 for the prior year third quarter. For the nine months ended September 30, 2023, net income totaled $9,408,000, a decrease of $406,000 from the same period the prior year. Earnings per share were $1.97 for the first nin |

OVBC ANNOUNCES CASH DIVIDENDOn Tuesday Oct. 17, 2023, Ohio Valley Banc Corp. [Nasdaq: OVBC] Board of Directors declared a cash dividend of $0.22 per common share payable on Nov. 10, 2023, to shareholders of record as of the close of business on Oct. 27, 2023. |

Is Now The Time To Put Ohio Valley Banc (NASDAQ:OVBC) On Your Watchlist?It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story... |

Ohio Valley Banc (NASDAQ:OVBC) shareholders have endured a 37% loss from investing in the stock five years agoIn order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market... |

OVBC Price Returns

| 1-mo | 17.65% |

| 3-mo | N/A |

| 6-mo | -1.68% |

| 1-year | -0.59% |

| 3-year | 5.44% |

| 5-year | -24.60% |

| YTD | 3.75% |

| 2023 | -9.28% |

| 2022 | -7.83% |

| 2021 | 30.06% |

| 2020 | -38.31% |

| 2019 | 14.52% |

OVBC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching OVBC

Here are a few links from around the web to help you further your research on Ohio Valley Banc Corp's stock as an investment opportunity:Ohio Valley Banc Corp (OVBC) Stock Price | Nasdaq

Ohio Valley Banc Corp (OVBC) Stock Quote, History and News - Yahoo Finance

Ohio Valley Banc Corp (OVBC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...