Paycom Software Inc. (PAYC): Price and Financial Metrics

PAYC Price/Volume Stats

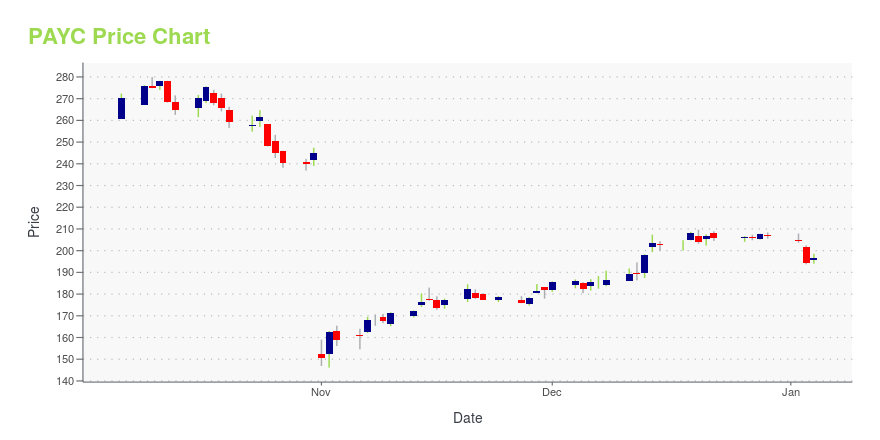

| Current price | $164.03 | 52-week high | $374.04 |

| Prev. close | $162.89 | 52-week low | $139.50 |

| Day low | $161.60 | Volume | 585,800 |

| Day high | $165.03 | Avg. volume | 848,401 |

| 50-day MA | $153.60 | Dividend yield | 0.91% |

| 200-day MA | $185.41 | Market Cap | 9.53B |

PAYC Stock Price Chart Interactive Chart >

Paycom Software Inc. (PAYC) Company Bio

Paycom Software, Inc., known simply as Paycom, is an American online payroll and human resource technology provider based in Oklahoma City, Oklahoma with offices throughout the United States. It is attributed with being one of the first fully online payroll providers. It has been recognized by Fortune and Forbes as one of the fastest-growing publicly traded companies in the world, and as one of the World's Most Innovative Enterprise Companies by Fast Company in 2022. Founded in 1998, it reported annual revenue of $1.06 billion for 2021, up from $841.1 million for 2020.(Source:Wikipedia)

Latest PAYC News From Around the Web

Below are the latest news stories about PAYCOM SOFTWARE INC that investors may wish to consider to help them evaluate PAYC as an investment opportunity.

The 500 Top Stocks to Buy for 2024, Ranked by AIThese are the very best stocks to buy for 2024 for any investor, according to Tom Yeung's MarketMasterAI system. |

Paycom Software (PAYC) Stock Drops Despite Market Gains: Important Facts to NoteThe latest trading day saw Paycom Software (PAYC) settling at $205.69, representing a -0.31% change from its previous close. |

The S&P 500 Could Soar Higher Soon: 2 Growth Stocks to Buy Now and Hold ForeverBullish indicators are flashing for the market, and these two stocks could be big winners. |

Is It Time to Buy the Dip on Paycom Stock?The software stock has plunged 45% from its 52-week high. |

Paycom Software (PAYC) Surpasses Market Returns: Some Facts Worth KnowingPaycom Software (PAYC) closed the most recent trading day at $206.60, moving +1.26% from the previous trading session. |

PAYC Price Returns

| 1-mo | 16.33% |

| 3-mo | -12.97% |

| 6-mo | -15.01% |

| 1-year | -54.23% |

| 3-year | -57.40% |

| 5-year | -29.63% |

| YTD | -20.32% |

| 2023 | -33.06% |

| 2022 | -25.26% |

| 2021 | -8.19% |

| 2020 | 70.82% |

| 2019 | 116.22% |

PAYC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PAYC

Want to see what other sources are saying about Paycom Software Inc's financials and stock price? Try the links below:Paycom Software Inc (PAYC) Stock Price | Nasdaq

Paycom Software Inc (PAYC) Stock Quote, History and News - Yahoo Finance

Paycom Software Inc (PAYC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...