Pembina Pipeline Corp. Ordinary Shares (Canada) (PBA): Price and Financial Metrics

PBA Price/Volume Stats

| Current price | $38.29 | 52-week high | $38.53 |

| Prev. close | $38.11 | 52-week low | $28.15 |

| Day low | $38.15 | Volume | 1,138,900 |

| Day high | $38.44 | Avg. volume | 1,099,301 |

| 50-day MA | $37.15 | Dividend yield | 5.27% |

| 200-day MA | $34.71 | Market Cap | 22.20B |

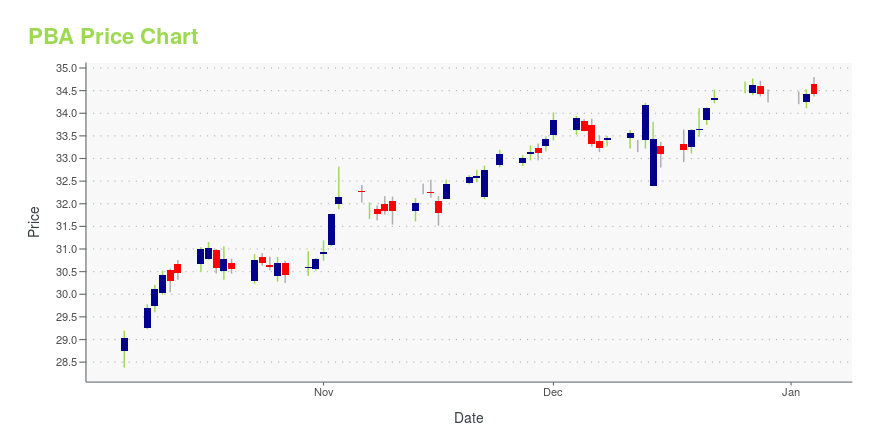

PBA Stock Price Chart Interactive Chart >

Pembina Pipeline Corp. Ordinary Shares (Canada) (PBA) Company Bio

Pembina Pipeline Corporation provides transportation and midstream services for the energy industry in North America. It operates through four businesses: Conventional Pipelines, Oil Sands & Heavy Oil, Gas Services, and Midstream. The company was founded in 1997 and is based in Calgary, Canada.

Latest PBA News From Around the Web

Below are the latest news stories about PEMBINA PIPELINE CORP that investors may wish to consider to help them evaluate PBA as an investment opportunity.

Oil & Gas Stock Roundup: Pembina's Asset Buy, Transocean's Rig Deal & MorePBA, RIG, EQNR, CVX and CNQ emerge as the energy headline makers during the week. |

Pembina Pipeline Corporation Announces Closing of $1.28 Billion Bought Deal Offering of Subscription ReceiptsCALGARY, Alberta, December 19, 2023--Pembina Pipeline Corporation ("Pembina" or the "Company") (TSX: PPL; NYSE: PBA) is pleased to announce that it has closed its previously announced bought deal offering (the "Offering") of subscription receipts ("Subscription Receipts"). Pursuant to the Offering, the Company issued 29,900,000 Subscription Receipts, including 3,900,000 Subscription Receipts issued pursuant to the exercise in full by the underwriters of their over-allotment option. The Subscript |

This 7.5%-Yielding Dividend Stock Continues to Make Moves to Enhance the Safety of Its Income StreamEnbridge is selling some assets to recycle that capital into its utility acquisitions. |

Pembina (PBA) to Buy Enbridge's Assets in a C$3.1-Billion DealPembina (PBA) agrees to buy Enbridge's assets in a C$3.1-billion deal, strengthening its leadership in transporting natural gas across North America. |

PRESS DIGEST- Wall Street Journal - Dec. 14The following are the top stories in the Wall Street Journal. - Chinese property giant Country Garden will sell a stake in a commercial center operator for about $428 million, using the proceeds to help restructure offshore debt. - The U.S. Treasury Department named two new deputies to help lead its sanctions enforcement and anti-money-laundering units, the agency said Wednesday. |

PBA Price Returns

| 1-mo | 4.30% |

| 3-mo | 8.38% |

| 6-mo | 13.49% |

| 1-year | 31.04% |

| 3-year | 40.19% |

| 5-year | 37.32% |

| YTD | 14.35% |

| 2023 | 7.79% |

| 2022 | 18.36% |

| 2021 | 32.40% |

| 2020 | -30.94% |

| 2019 | 31.16% |

PBA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PBA

Here are a few links from around the web to help you further your research on Pembina Pipeline Corp's stock as an investment opportunity:Pembina Pipeline Corp (PBA) Stock Price | Nasdaq

Pembina Pipeline Corp (PBA) Stock Quote, History and News - Yahoo Finance

Pembina Pipeline Corp (PBA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...