PC-Tel, Inc. (PCTI): Price and Financial Metrics

PCTI Price/Volume Stats

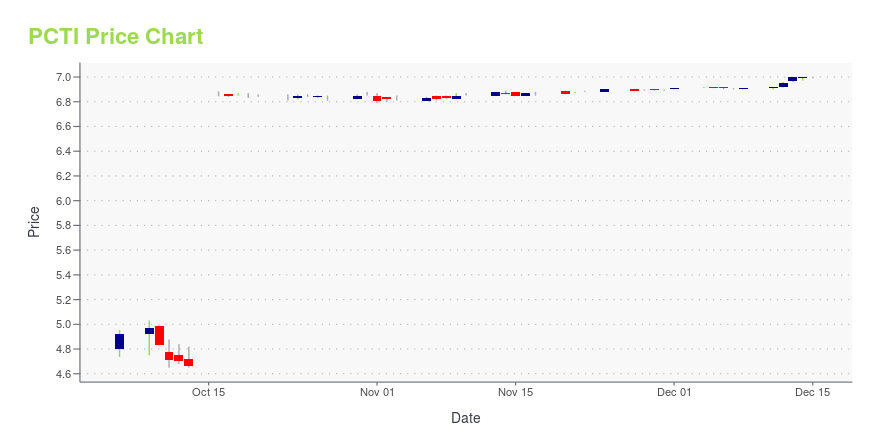

| Current price | $6.99 | 52-week high | $7.00 |

| Prev. close | $7.00 | 52-week low | $3.78 |

| Day low | $6.99 | Volume | 143,800 |

| Day high | $7.00 | Avg. volume | 91,742 |

| 50-day MA | $6.63 | Dividend yield | 3.15% |

| 200-day MA | $5.08 | Market Cap | 135.28M |

PCTI Stock Price Chart Interactive Chart >

PC-Tel, Inc. (PCTI) Company Bio

PCTEL, Inc. provides performance critical telecom solutions worldwide. It operates through two segments, RF Solutions and Connected Solutions. The company was founded in 1994 and is based in Bloomingdale, Illinois.

Latest PCTI News From Around the Web

Below are the latest news stories about PC TEL INC that investors may wish to consider to help them evaluate PCTI as an investment opportunity.

PCTEL Announces Closing of its Acquisition by Amphenol CorporationBLOOMINGDALE, Ill., December 15, 2023--PCTEL, Inc. (Nasdaq: PCTI) ("PCTEL" or the "Company"), a leading global provider of wireless technology solutions, today announced that it has been acquired by Amphenol Corporation (NYSE: APH) ("Amphenol"), one of the world’s largest providers of high-technology interconnect, sensor and antenna solutions. Under the terms of the previously announced agreement, PCTEL stockholders are receiving $7.00 in cash for each share of common stock they own. Following t |

PCTEL Joins Cradlepoint Technology Alliance ProgramBLOOMINGDALE, Ill., November 16, 2023--PCTEL, Inc. (Nasdaq: PCTI), a leading global provider of wireless technology solutions, today announced it has joined Cradlepoint’s Technology Alliance Partner Program. PCTEL’s work with Cradlepoint represents the continuation of the collaboration between the two companies in previous successful projects. Together, PCTEL and Cradlepoint can help customers optimize connectivity performance and coverage by providing them the right antenna with the right 4G/5G |

PCTEL Announces New Embedded Antenna PlatformBLOOMINGDALE, Ill., November 15, 2023--PCTEL, Inc. (Nasdaq: PCTI), a leading global provider of wireless technology solutions, today announced its new embedded antenna platform for integrated radio deployments. |

PCTEL Inc (PCTI) Reports Decline in Q3 Revenue and Adjusted EBITDA Amid Pending Merger with AmphenolFinancial Performance Reflects Challenges in Antennas and Test & Measurement Segments |

PCTEL Reports Third Quarter Financial ResultsBLOOMINGDALE, Ill., November 08, 2023--PCTEL, Inc. (Nasdaq: PCTI) ("PCTEL" or the "Company"), a leading global provider of wireless technology solutions, today reported results for the third quarter ended September 30, 2023. |

PCTI Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 42.30% |

| 3-year | 18.91% |

| 5-year | 74.72% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -20.48% |

| 2021 | -10.91% |

| 2020 | -19.75% |

| 2019 | 105.93% |

PCTI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PCTI

Here are a few links from around the web to help you further your research on Pc Tel Inc's stock as an investment opportunity:Pc Tel Inc (PCTI) Stock Price | Nasdaq

Pc Tel Inc (PCTI) Stock Quote, History and News - Yahoo Finance

Pc Tel Inc (PCTI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...