PennantPark Floating Rate Capital Ltd. (PFLT): Price and Financial Metrics

PFLT Price/Volume Stats

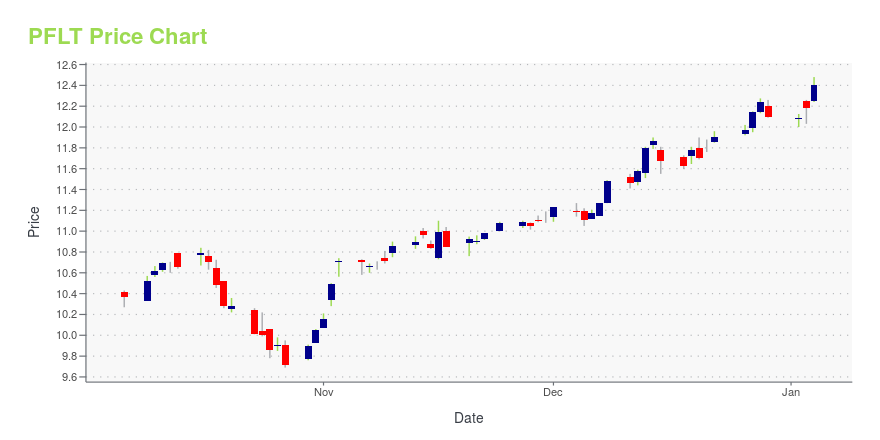

| Current price | $11.41 | 52-week high | $12.63 |

| Prev. close | $11.37 | 52-week low | $9.69 |

| Day low | $11.36 | Volume | 673,600 |

| Day high | $11.47 | Avg. volume | 762,127 |

| 50-day MA | $11.45 | Dividend yield | 10.82% |

| 200-day MA | $11.32 | Market Cap | 761.37M |

PFLT Stock Price Chart Interactive Chart >

PennantPark Floating Rate Capital Ltd. (PFLT) Company Bio

PennantPark Floating Rate Capital Ltd. is a business development company. The Company is a closed-end, externally managed and non-diversified investment company. Its investment objectives are to generate current income and capital appreciation by investing primarily in floating rate loans and other investments made to the United States middle-market companies. The company is based in New York City, New York.

Latest PFLT News From Around the Web

Below are the latest news stories about PENNANTPARK FLOATING RATE CAPITAL LTD that investors may wish to consider to help them evaluate PFLT as an investment opportunity.

7 Growth Stocks That Also Pay Monthly Dividends: December 2023While it’s obvious there are great reasons to buy and hold stocks, it’s also easy to overlook a regular income gained by owning monthly dividend-paying growth stocks. |

PennantPark Floating Rate Capital Ltd. Announces Monthly Distribution of $0.1025 per ShareMIAMI, Dec. 04, 2023 (GLOBE NEWSWIRE) -- PennantPark Floating Rate Capital Ltd. (the "Company") (NYSE: PFLT) (TASE: PFLT) declares its monthly distribution for December 2023 of $0.1025 per share, payable on January 2, 2024 to stockholders of record as of December 18, 2023. The distribution is expected to be paid from taxable net investment income. The final specific tax characteristics of the distribution will be reported to stockholders on Form 1099 after the end of the calendar year and in the |

PennantPark Floating Rate Capital Ltd. Announces Financial Results for the Fourth Quarter and Fiscal Year Ended September 30, 2023MIAMI, Nov. 15, 2023 (GLOBE NEWSWIRE) -- PennantPark Floating Rate Capital Ltd. (NYSE: PFLT) (TASE: PFLT) announced today financial results for the fourth quarter and fiscal year ended September 30, 2023. HIGHLIGHTS Quarter ended September 30, 2023 (Unaudited) ($ in millions, except per share amounts) Assets and Liabilities: Investment portfolio(1) $1,067.2 Net assets $653.6 GAAP net asset value per share $11.13 Quarterly increase in GAAP net asset value per share 1.6%Adjusted net asset value pe |

PennantPark Floating Rate Capital Ltd. Schedules Earnings Release of Fourth Fiscal Quarter 2023 ResultsMIAMI, Oct. 13, 2023 (GLOBE NEWSWIRE) -- PennantPark Floating Rate Capital Ltd. (the "Company") (NYSE: PFLT) (TASE:PFLT) announced that it will report results for the fourth fiscal quarter ended September 30, 2023 on Wednesday, November 15, 2023 after the close of the financial markets. The Company will also host a conference call at 9:00 a.m. (Eastern Time) on Thursday November 16, 2023 to discuss its financial results. All interested parties are welcome to participate. You can access the confe |

7 Great Growth Stocks That Pay a Monthly DividendThe only thing better than growth stocks are finding growth stocks that pay a monthly dividend. |

PFLT Price Returns

| 1-mo | 0.95% |

| 3-mo | 1.98% |

| 6-mo | 4.71% |

| 1-year | 15.33% |

| 3-year | 18.68% |

| 5-year | 64.89% |

| YTD | 0.35% |

| 2023 | 23.01% |

| 2022 | -5.53% |

| 2021 | 32.64% |

| 2020 | -1.41% |

| 2019 | 14.63% |

PFLT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PFLT

Here are a few links from around the web to help you further your research on PennantPark Floating Rate Capital Ltd's stock as an investment opportunity:PennantPark Floating Rate Capital Ltd (PFLT) Stock Price | Nasdaq

PennantPark Floating Rate Capital Ltd (PFLT) Stock Quote, History and News - Yahoo Finance

PennantPark Floating Rate Capital Ltd (PFLT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...