Koninklijke Philips N.V. ADR (PHG): Price and Financial Metrics

PHG Price/Volume Stats

| Current price | $25.76 | 52-week high | $29.44 |

| Prev. close | $25.75 | 52-week low | $17.75 |

| Day low | $25.69 | Volume | 711,159 |

| Day high | $25.88 | Avg. volume | 1,031,016 |

| 50-day MA | $26.34 | Dividend yield | 3.53% |

| 200-day MA | $22.58 | Market Cap | 24.21B |

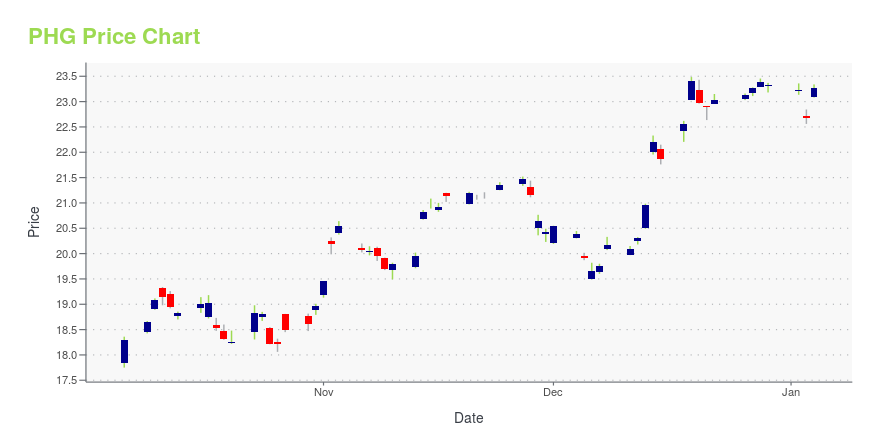

PHG Stock Price Chart Interactive Chart >

Koninklijke Philips N.V. ADR (PHG) Company Bio

Koninklijke Philips N.V. (lit. 'Royal Philips'), commonly shortened to Philips, is a Dutch multinational conglomerate corporation that was founded in Eindhoven in 1891. Since 1997, it has been mostly headquartered in Amsterdam, though the Benelux headquarters is still in Eindhoven. Philips was formerly one of the largest electronics companies in the world, but is currently focused on the area of health technology, having divested its other divisions. (Source:Wikipedia)

Latest PHG News From Around the Web

Below are the latest news stories about KONINKLIJKE PHILIPS NV that investors may wish to consider to help them evaluate PHG as an investment opportunity.

Philips recalls MRI machines due to risk of explosionThe Food and Drug Administration labeled the recall as a Class I event. There has been one report of a machine exploding in the 22 years the system has been in use. |

Resmed posts notice about risk of mask magnets interfering with medical implantsLike its rival Philips, Resmed has determined that patients should not wear magnetized masks near some implants. |

Philips recalls some imaging machines on explosion concernsRoyal Philips (PHG) is recalling about 150 MRI machines in the US on concerns of explosion risks caused by a buildup of helium gas. The medical device company says it has inspected about 95% of the recalled machines in the US and plans to complete the rest of the inspections shortly. Shares of Royal Philips fell about 1%. For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live. |

UPDATE 1-US FDA identifies recall of Philips medical imaging devices as most seriousThe U.S. Food and Drug Administration (FDA) on Wednesday classified the recall of Philips' medical imaging devices as most serious as their use could cause serious injuries or death. Philips was recalling some models of the Panorama 1.0T HFO device in the U.S. due to risk of explosion during a "quench procedure" caused by excessive buildup of helium gas. During the procedure, a large amount of helium evaporates and is allowed to pass out through a venting system. |

US FDA identifies recall of Philips medical imaging devices as most seriousThe U.S. Food and Drug Administration (FDA) on Wednesday classified the recall of Philips' medical imaging devices as most serious as their use could cause serious injuries or death. The Dutch medical devices maker started the process on Nov. 30 this year and has recalled 150 devices in the United States. Philips was recalling some models of the Panorama 1.0T HFO device in the U.S. due to risk of explosion during a "quench procedure" caused by excessive buildup of helium gas. |

PHG Price Returns

| 1-mo | -0.16% |

| 3-mo | 26.72% |

| 6-mo | 17.31% |

| 1-year | 29.61% |

| 3-year | -36.63% |

| 5-year | -35.32% |

| YTD | 14.44% |

| 2023 | 62.75% |

| 2022 | -57.98% |

| 2021 | -30.94% |

| 2020 | 15.40% |

| 2019 | 41.74% |

PHG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PHG

Here are a few links from around the web to help you further your research on Koninklijke Philips Nv's stock as an investment opportunity:Koninklijke Philips Nv (PHG) Stock Price | Nasdaq

Koninklijke Philips Nv (PHG) Stock Quote, History and News - Yahoo Finance

Koninklijke Philips Nv (PHG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...