Parke Bancorp, Inc. (PKBK): Price and Financial Metrics

PKBK Price/Volume Stats

| Current price | $20.06 | 52-week high | $20.87 |

| Prev. close | $19.75 | 52-week low | $15.16 |

| Day low | $19.46 | Volume | 22,500 |

| Day high | $20.09 | Avg. volume | 24,864 |

| 50-day MA | $16.73 | Dividend yield | 3.71% |

| 200-day MA | $17.28 | Market Cap | 239.98M |

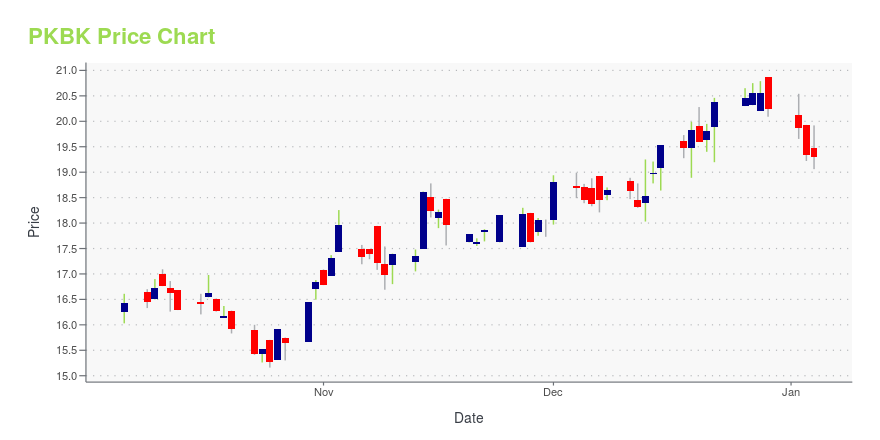

PKBK Stock Price Chart Interactive Chart >

Parke Bancorp, Inc. (PKBK) Company Bio

Parke Bancorp, Inc. operates as the bank holding company for Parke Bank that provides personal and business financial services to individuals and small to mid-sized businesses in New Jersey. The company was founded in 1999 and is based in Washington Township, New Jersey.

Latest PKBK News From Around the Web

Below are the latest news stories about PARKE BANCORP INC that investors may wish to consider to help them evaluate PKBK as an investment opportunity.

Why You Might Be Interested In Parke Bancorp, Inc. (NASDAQ:PKBK) For Its Upcoming DividendReaders hoping to buy Parke Bancorp, Inc. ( NASDAQ:PKBK ) for its dividend will need to make their move shortly, as the... |

Parke Bancorp (NASDAQ:PKBK) Has Announced A Dividend Of $0.18Parke Bancorp, Inc. ( NASDAQ:PKBK ) has announced that it will pay a dividend of $0.18 per share on the 17th of... |

PARKE BANCORP, INC. ANNOUNCES CASH DIVIDENDParke Bancorp, Inc. (the "Company") (NASDAQ: PKBK) today announced the declaration of a $0.18 per share cash dividend, payable on January 17, 2024, to its stockholders of record as of the close of business on January 3, 2024. |

Parke Bancorp Inc (PKBK) Announces Q3 2023 Earnings Amidst ChallengesNet Income Drops to $1.0 Million, Revenue Increases by 6.92% Over Q2 2023 |

PARKE BANCORP, INC. ANNOUNCES THIRD QUARTER 2023 EARNINGSParke Bancorp, Inc. ("Parke Bancorp" or the "Company") (NASDAQ: "PKBK"), the parent company of Parke Bank, announced its operating results for the three and nine months ended September 30, 2023. |

PKBK Price Returns

| 1-mo | 26.50% |

| 3-mo | 23.27% |

| 6-mo | 7.66% |

| 1-year | 9.55% |

| 3-year | 12.66% |

| 5-year | 11.42% |

| YTD | 2.19% |

| 2023 | 1.74% |

| 2022 | 0.40% |

| 2021 | 40.85% |

| 2020 | -29.33% |

| 2019 | 39.50% |

PKBK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PKBK

Want to do more research on Parke Bancorp Inc's stock and its price? Try the links below:Parke Bancorp Inc (PKBK) Stock Price | Nasdaq

Parke Bancorp Inc (PKBK) Stock Quote, History and News - Yahoo Finance

Parke Bancorp Inc (PKBK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...