Park-Ohio Holdings Corp. (PKOH): Price and Financial Metrics

PKOH Price/Volume Stats

| Current price | $30.58 | 52-week high | $31.95 |

| Prev. close | $30.87 | 52-week low | $17.41 |

| Day low | $30.07 | Volume | 26,923 |

| Day high | $31.25 | Avg. volume | 26,039 |

| 50-day MA | $26.05 | Dividend yield | 1.65% |

| 200-day MA | $25.12 | Market Cap | 399.71M |

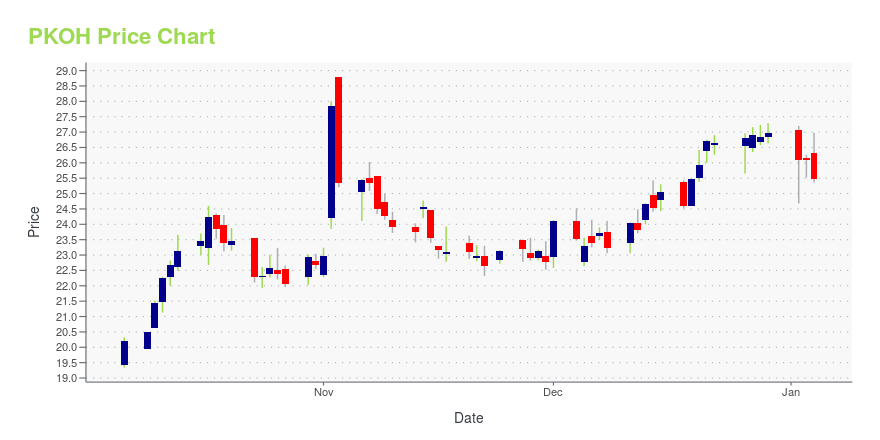

PKOH Stock Price Chart Interactive Chart >

Park-Ohio Holdings Corp. (PKOH) Company Bio

Park-Ohio Holdings Corporation operates as an industrial supply chain logistics and diversified manufacturing company in the United States, Canada, Europe, Asia, Mexico, and other countries. The company operates in three segments: Supply Technologies, Assembly Components, and Engineered Products. The company was founded in 1961 and is based in Cleveland, Ohio.

Latest PKOH News From Around the Web

Below are the latest news stories about PARK OHIO HOLDINGS CORP that investors may wish to consider to help them evaluate PKOH as an investment opportunity.

Park-Ohio Holdings Corp. (NASDAQ:PKOH) is largely controlled by institutional shareholders who own 53% of the companyKey Insights Institutions' substantial holdings in Park-Ohio Holdings implies that they have significant influence over... |

Should You Be Worried About Park-Ohio Holdings Corp.'s (NASDAQ:PKOH) 6.8% Return On Equity?While some investors are already well versed in financial metrics (hat tip), this article is for those who would like... |

ParkOhio Announces Ratings Upgrade from Moody’sCLEVELAND, OHIO, November 20, 2023--Park-Ohio Holdings Corp. (NASDAQ: PKOH) announced today that Moody’s Investors Service, Inc. ("Moody’s") has upgraded the ratings of ParkOhio Industries, Inc. ("ParkOhio"), including the Corporate Family Rating ("CFR") to B2 from B3, and the Senior Unsecured Rating to Caa1 from Caa2. |

Insider Sell Alert: Director MOORE DAN T III Sells 6,316 Shares of Park-Ohio Holdings Corp (PKOH)In a notable insider transaction, Director MOORE DAN T III has parted with 6,316 shares of Park-Ohio Holdings Corp (NASDAQ:PKOH), a significant move that warrants a closer look by investors and market analysts. |

Insider Sell Alert: Director MOORE DAN T III Sells Shares of Park-Ohio Holdings Corp (PKOH)In a recent transaction on November 9, 2023, Director MOORE DAN T III of Park-Ohio Holdings Corp (NASDAQ:PKOH) sold 10,239 shares of the company's stock. |

PKOH Price Returns

| 1-mo | 20.73% |

| 3-mo | 27.56% |

| 6-mo | 21.14% |

| 1-year | 67.49% |

| 3-year | 13.84% |

| 5-year | 8.48% |

| YTD | 14.58% |

| 2023 | 127.07% |

| 2022 | -40.25% |

| 2021 | -30.26% |

| 2020 | -7.34% |

| 2019 | 11.39% |

PKOH Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PKOH

Want to see what other sources are saying about Park Ohio Holdings Corp's financials and stock price? Try the links below:Park Ohio Holdings Corp (PKOH) Stock Price | Nasdaq

Park Ohio Holdings Corp (PKOH) Stock Quote, History and News - Yahoo Finance

Park Ohio Holdings Corp (PKOH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...